Asset class trends in emerging markets

Public equity funds dedicated to impact in emerging markets provide an accessible entry point for investors seeking liquid options

Since the introduction of the Sustainable Development Goals (SDGs), there has been growth in public equity funds focused on emerging markets and impact investing:

- Listed equities in emerging markets are growing, with more companies reaching the size required to be traded on public stock exchanges

- Public equities are the second fastest growing asset class in impact investing, up 25% between 2014 and 2018

- Interest in the SDGs has spurred a range of new listed funds by traditional asset managers focused on impact, including in emerging markets

- SDG-focused investors target companies with a clear impact thesis, rather than just screening out by Environmental, Social and Governance (ESG) guidelines

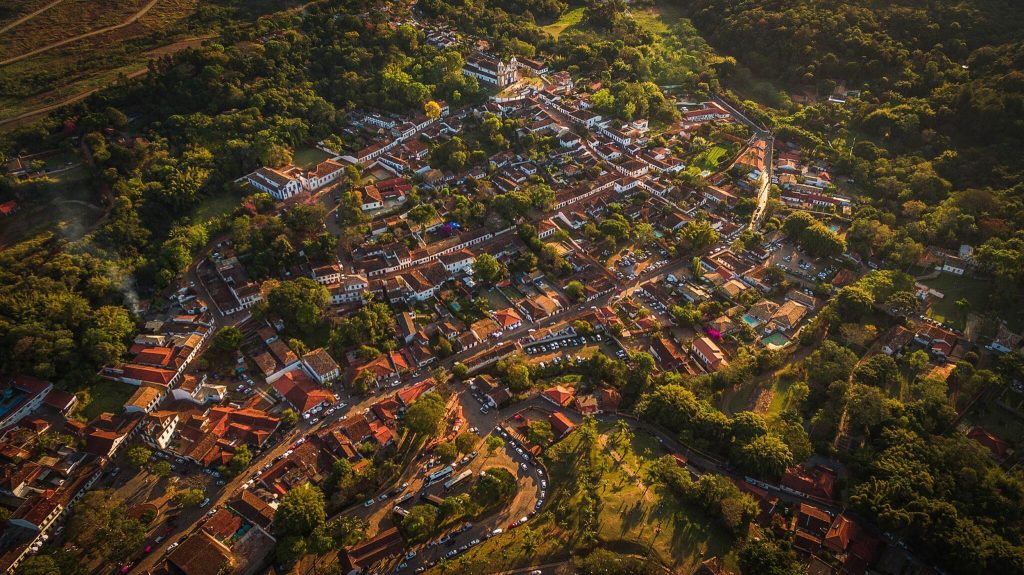

Investment focus: Emerging markets listed funds generally focus on East Asia and larger economies such as Brazil, Russia, India, China and South Africa (BRICs), rather than frontier markers, due to higher market capitalisation stock exchanges, more attractive opportunities and greater stability

Key features

Liquidity: A public market focus provides relatively high liquidity compared to private markets emerging impact opportunities

Fund managers with strong track records: Large global fund managers who have started offering SDG-focused funds have strong track records and performance is transparent in this space

Low costs: Public equity funds typically have lower cost structures than private funds, with lower management fees and limited withdrawal or exit levies

Historical challenges

Risk profile: Concerns around the business execution capabilities of firms in emerging markets, as well as political and currency risks

- Solutions include: Careful portfolio selection can deliver above average returns, including consideration of companies’ governance and capabilities to scale

Perceived risk of impact washing: While there are many public equity funds marketing themselves as ‘impact’ or ‘SDG’ focused, the rigorousness of their criteria or impact reporting is variable

- Solutions include: Several industry-wide initiatives are emerging to standardise investment selection criteria and measurement tools (e.g. Global Impact Investing Network listed equities working group)

Why invest?

Deepening financial infrastructure: Public markets are so thinly traded that attention from developed market investors is a useful contribution to developing the financial infrastructure, including raising standards of governance and professional practice

Accessible asset class: These funds provide ‘entry-level’ opportunities for new investors discovering the emerging markets and/or impact space

Examples of public equity bonds in emerging markets include:

-

Emerging Markets Sustainable Impact Fund

The Emerging Markets Sustainable Impact Fund is a public equity accumulating sub-fund under Nomura Ireland plc. The fund is an actively managed portfolio of emerging market equities launched in March 2020, investing in companies contributing to the 17 Sustainable Development Goals.