Ambition:

The fund aims to increase access to energy through investments in electricity generation in emerging markets

• Climate and Environmental Action: Climate mitigation is one of the main impact goals; renewable energy is the primary target sector

• Socio-economic Distribution and Equity: Access to energy and job creation are some other main impact goals; further, the fund seeks to support the growth of SMEs and tracks further impact KPIs

• Community Voice: Community liaison officers are appointed at every project; they play a key role in ensuring a regular two-way exchange of information between the local community and the project

Description of the fund

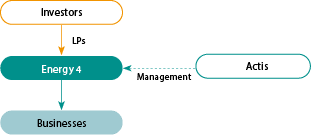

Energy 4 is Actis’ fourth energy-focused private equity fund investing in electricity generation (buy and build) and distribution businesses (buy and improve) in select countries across Latin America, Africa and Asia.

The fund invests across renewables (wind, solar and hydro) and gas technologies.

Manager

Actis was founded in 2004 (spun-out of CDC) and has $10 billion AUM.

The manager has raised $19 billion since inception, executing over 200 transaction across over 40 countries, including transactions worth $2 billion in the energy sector through four energy-focused funds.

Actis has 90 investment professionals across 12 offices.

Investors

Leading US state and local pension funds, sovereign wealth funds, insurance companies and endowments.

Key attraction points for institutional investors

- Proven strategy with attractive returns, backed by a large market opportunity

- Actis’ investment track record and local offices and network

- Strong on ESG, providing measurable and reportable impact

- Sizeable re-ups from previous investors into Energy 4

Key Terms

Fund level

- Vehicle/fund type: Closed-end private equity fund

- Fund size: Actual $2.75 billion (versus initial target of $2 billion)

- Blending and/or TA: N/A

- Sponsor/anchor: Actis GP LLP

- Term/investment period: 10 years / 5 years

- Target return: Confidential

- Management fee: Confidential

- Vintage (first close): 2016

- Co-investment rights: Yes

- Other: N/A

Investee level (investment strategy)

- Instrument(s): Equity

- Target investee type(s): Private infrastructure development projects

- Target sector(s): Renewable electricity generation businesses (wind, solar, hydro); electricity distribution businesses; gas power generation

- Target geography(ies): Latin America, Africa and Asia

- Investment tenor: 5-year holding

- Investment currency: Hard currency (USD)

Pipeline and portfolio

Market opportunity

The Problem: 1.3 billion people in emerging countries lack access to electricity.

The Opportunity: Demand for electricity and quality infrastructure is high and rising with energy being crucial to a country’s development. At time of launch, Actis estimated

the investment opportunity in non-OECD markets to amount to $10 trillion up to 2035 with electricity demand to grow 3x faster than in OECD countries.

Pipeline: Energy 4’s capital has been deployed and the focus is now on value creation and exits.

Just transition in the investment process

- Due diligence includes assessment of ESG information, examination of impact of ESG issues on business and how ESG risks will be addressed or how opportunities for value creation will be seized

- Community development plans developed and implemented at every project in order to maximise local benefits and employment opportunities.

Structure & risks

Jurisdiction: UK

Legal form: Limited partnership

Capital structure: Limited partnership interests

Key risks

| Key risks | Mitigant(s) |

|---|---|

| Geographic | Political risk insurance where possible; local presence |

| Currency | USD denominated contracts, where possible; focus on capital gains |

| Execution | On-the-ground research and local presence; local networks |

Outcomes framework

Climate and social metrics

Examples include:

- Climate and Environmental Action: Including CO2 emissions avoided (tCO2e), water usage (l) (environment); clean electricity generation (GW – infrastructure)

- Socio-economic Distribution and Equity: Examples of indicators include employment (jobs created), training, health and safety (people reached), taxes ($ – finance), access to energy (people connected – infrastructure)

- Community Voice: CSR with local communities ($ spent and people reached – social and community)

Framework and reporting

Actis has developed a proprietary impact measurement framework: Actis Impact Score (AIS). The AIS, launched in 2019, allows for impact target setting and measurement across all investments.

- Reporting standard: AIS is based on the IMP’s five dimensions of impact

- Transparency: Details about the AIS are available via the Actis website

- Third-party verification: Yes. Actis is a signatory to the IFC’s Operating Principles for Impact Management and Actis’ disclosure statement was independently verified by PwC

Select areas of Just Transition enhancement

- Could the fund expand its ambition statement to include targets for all three Elements of the Just Transition?

- Could the climate and environmental strategy include a clear assessment of the sustainability of projects (such as climate smart approaches like efficient building materials, waste and water efficiency), including also an assessment of the supply chain?

Investee in the spotlight

Investing in Taiba project, part of Lekela – Wind farm in Senegal (Fund: Actis Energy 3)

Background

Parc Eolien Taiba N’Diaye (PETN) is the first utility scale wind power project in Senegal. At 159 MW installed capacity, it is the largest wind farm in the West Africa region. The project has been developed since 2016 by Actis’ majority-owned renewable power platform, Lekela Power.

At the commencement of the project, only 65% of the population of Senegal had access to electricity, 88% of the country’s generation capacity was provided by burning oil and diesel, and Senegal had one of the highest generation costs in the world due to its reliance on imported fuel.

Once fully constructed, the project will provide clean, reliable power to Senegal’s electricity grid, increasing the electricity generation capacity for the country by 15%.

Actis has won the climate change impact project/investment of the year at the inaugural 2020 Environmental Finance IMPACT Awards.

Investment

PETN required a total investment of approximately $330 million, which was achieved through equity investment by Lekela Power – a joint venture between Actis (60%) and Mainstream Renewable Power (40%) – and debt.

Impact

Climate and Environmental Action: The aim is to offset ~6 million tonnes of carbon emissions over the project life. In 2020, the level stood at 1,511,619 tonnes of CO2 avoided.

Socio-economic Distribution and Equity: The investment aims to provide clean power for over two million people for at least 20 years and create 830 employment opportunities for local people during the peak of its construction phase.

The 2020 performance stood at over 1,067 workers employed at the peak of construction, of which over 95% workers were project country nationals and over 33% from local communities.

The project aims to reduce (by ~65%) the cost of electricity in a country that experiences some of the world’s highest prices. The project has also funded technical traineeships for 12 young engineers. As part of the objective to generate significant positive shared benefits for the local communities, a programme of socio-economic investments was also started, this includes investing in education, enterprise and the environment. By 2020, 127 community investment initiatives across six communities had occurred. This will continue throughout the lifetime of the wind farm and up to $20 million will be invested by Lekela in the Taiba N’Diave region. The project opened a new marketplace in Taiba N’Diaye with over 60 covered stalls that allowed women to relocate from the makeshift roadside shelters to sell their agricultural products.

Community Voice: Lekela’s engagement with stakeholders extends beyond validating the ESG issues that matter to them. They recognise the operations impact local communities and that local active stakeholder engagement, in a participatory manner, is necessary. They have strong community engagement and consultation, community investment to support jobs and develop skills and ensure responsible land use and development.