The Emerging Africa Infrastructure Fund (EAIF) is a multi-donor fund mobilising capital to provide long-term debt to businesses creating, expanding or improving essential infrastructure in Sub-Saharan Africa. EAIF has a 15-year track record, providing USD 713 million in financing to 71 projects across Africa.

Geography: Sub-Saharan Africa

Size: USD 1.05 billion (raised)

Impact thesis: infrastructure development

Fund manager: Ninety One

Total assets under management (AUM): GBP 103.4 million

Ninety One (founded 1991) has its headquarters in Johannesburg. Specialising in emerging market investing, Ninety One currently manages nine public-private emerging markets debt funds and four emerging markets equity funds.

Investment overview

| Key fund limited partners (LPs) / Investors | Allianz (10.5%) |

| Other investors | Department for International Development (Now Foreign, Commonwealth & Development Office), the Swiss State Secretariat for Economic Affairs (SECO), the Swedish International Development Cooperation Agency (SIDA), the Dutch Directorate-General for International Cooperation (DGIS), the Dutch Development Bank (FMO), the German Development Bank (KFW), The African Development Bank Group (AfDB) |

| Instrument type | Commercial debt |

| Investment size in portfolio companies | USD 10–50 million |

| Time horizon | Fund tenors of 5 – 20 years |

Financial return profile

Returns:

- Target commercial-rate returns

Track Record: EAIF has a 15-year track record, covering 71 private infrastructure projects across Africa

Liquidity:

- Loan tenors of 5 – 20 years

Risk profile

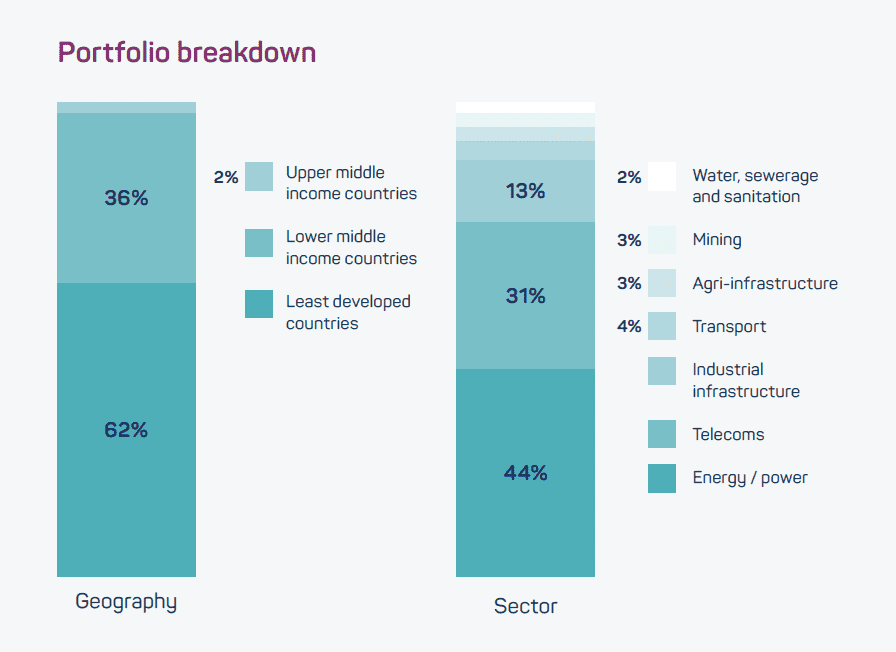

Currency risk: Lends predominantly in USD and EUR

Execution risk: Only two debt writedowns for more than 70 projects

Concentration risk: Limits on portfolio concentration of 25% per country, 10% per client, and 40% per sector (excluding energy)

Risk mitigation: First-loss equity from donor investors

Investment thesis

15-year track record financing 71 African infrastructure projects

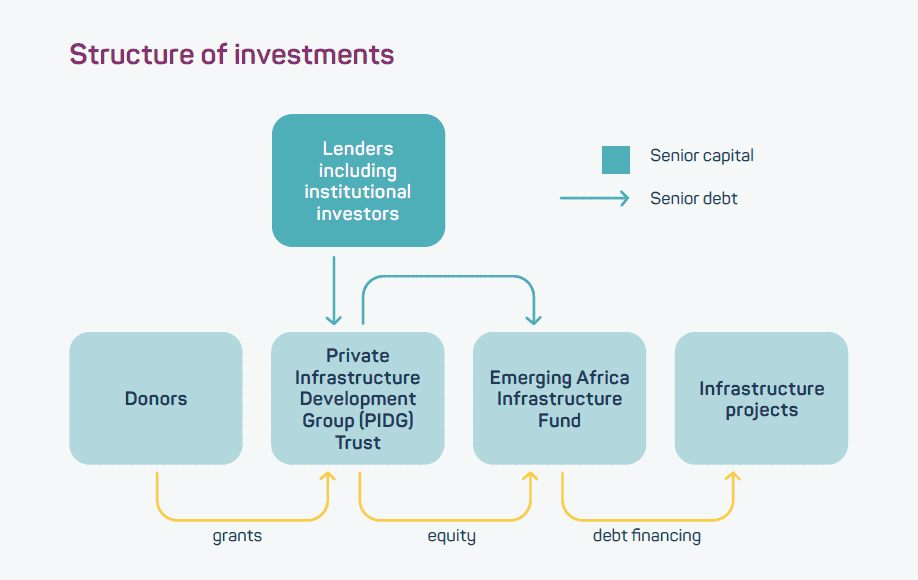

Leverage donor capital to de-risk private investments and ensure commercial private returns, capitalised with USD 491 million in first-loss equity and USD 627 million in senior debt

First-loss equity contributed by Private Infrastructure Development Group (PIDG) members via PIDG Trust on sub-commercial terms, no dividend distribution, profits retained

Senior debt provided by commercial banks, institutional investors, multilateral development banks (MDBs) and development finance institutions (DFIs) on commercial terms, sits on top of equity tranche to reduce risk profile of senior lenders

Investment selection

Eligible investments

Private infrastructure projects, including start-ups / greenfield projects and privatised companies within:

- Energy

- Transportation

- Agriculture

- Mining

- Telecommunications

- Gas transportation

- Water / waste management

- Infrastructure components and equipment

Due diligence approach

- Initial screening: Project background, sponsor / off-credit standing, and ESG standards evaluated

- Due diligence: Due diligence / credit evaluation

- EAIF-Ninety One credit committee: Evaluates credit case and country political / economic risk

- PIDG credit committee: Evaluates deals that are challenging and require additional scrutiny

Impact targeting

Impact thesis

Theory of change:

- Extending / upgrading essential infrastructure supports economic growth and reduces poverty

- Infrastructure projects create both temporary and permanent jobs

Target stakeholders: Communities in Sub-Saharan Africa see increased job creation and reduced poverty

Impact metrics and outcomes

Output and outcome metrics:

- Capital mobilisation: Mobilisation of commercial / DFI capital

- Visibility / sustainability: Reaching financial close / achieving operational sustainability

- Access: People with access to new / improved infrastructure

- Employment: Short- / long-term jobs created

- Economic impact: Value / opportunities created for local business

- Development impact: Local tax revenue and income generated / project-specific indicators

- Demonstration effect: Indirect capital mobilisation

Reporting: Project fact sheets / case studies report key metrics

Fund impact outcomes to date:

- Access to new / improved infrastructure for 129 million people

- 48,390 jobs created, of which 22,325 permanent

Portfolio investee spotlights

Azura-Edo, Nigeria

Gas power station – Energy generation

The Azura-Edo power station is a 450 megawatt (MW) gas power station near Benin City. EAIF provided USD 30 million in debt financing to the USD 865 million project, which won the 2015 Thomson Reuters Project Finance International (PFI) African Public/Private Partnership Award.

Azura-Edo supplies approximately 22 million people with electricity, many of whom were able to access electricity from the national grid for the first time and for a lower cost than off-grid energy. 1,000 people constructed the plant, and 60 permanent operations jobs were created.

Kigali Water Limited, Rwanda

Bulk surface water supply – Water management

EAIF led the arrangement of USD 40.6 million of financing for the USD 60.8 million Kigali water plant, providing USD 2.6 million in junior debt and USD 19 million in senior debt itself, both with 18-year tenors. The project is the first bulk water surface supply in

Sub-Saharan Africa and won the IJGlobal African Water Deal of 2017. The plant, operational from 2020, will have the capacity to produce 40 megalitres of water per day, directly supplying 500,000 people with clean water. The project is expected to generate 100 construction jobs and 50 permanent management jobs

Institutional investor spotlight: Allianz

Investment: Around USD 120 million

In 2018, Allianz committed to providing debt financing of EUR 75 million and USD 25 million, both over 12 years. Allianz stated that EAIF created value for Allianz’s customers and fitted excellently into their international investment strategy.

Claus Fintzen, Chief Investment Officer for Infrastructure Debt at Allianz Global Investors, said that the deal was structured such that its loans were “risk remote” as they were backed by collateral in more than 40 projects. He added that Allianz’s fiduciary responsibility was satisfied given the interest rate was “more attractive than listed emerging market debt available on the market.”

“We believe in Africa’s growth potential and will invest across different asset classes across the continent. The partnership with EAIF and [Ninety One] is an important contribution to this initiative and illustrates how to create attractive risk and return profiles with the necessary downside protection for our policyholders”

Sebastian Schroff, Global Head of Private Debt, Allianz Investment Management

Other similar opportunities in the market

- In 2018, DFI de-risking helped to finance projects with a total volume of more than USD 6 billion, using a combination of concessional funds and DFI own resources to mobilise private sector finance of USD 1.7 billion

- In Sub-Saharan Africa alone, these projects totalled more than USD 1.3 billion in 2018

- DFIs collectively committed USD 997.7 million in DFI managed concessional finance and DFI own-account commitments to public-private infrastructure projects in 2018

Key observations for institutional investors

Alignment with trustee fiduciary responsibility is possible

De-risking tools which alter the risk structure for private investors ensure that risk / return profiles are competitive and align with trustee fiduciary responsibilities

Allianz’s fiduciary responsibilities were satisfied given the interest rate was “more attractive than listed emerging market debt available on the market” (Claus Fintzen, Chief Investment Officer for Infrastructure Debt, Allianz Global Investors)

Public capital can de-risk emerging market investments

First-loss equity from donor organisations mitigates risks associated with emerging market investment

“We would only lose money if all the other equity investors are taken out.” (Claus Fintzen, Chief Investment Officer for infrastructure debt, Allianz Global Investors)

Track records demonstrate emerging markets investment viability

An established fund track record demonstrates the viability of impact investments in emerging markets, building confidence in future investment opportunities

EAIF has only experienced two debt writedowns over more than 70 projects across 22 countries over a 16-year history

Investible impact opportunities are available at scale

Commercial-rate returns which generate large-scale, measurable impact are available at a sufficient scale for institutional investors

EAIF’s investments in portfolio projects / companies range from USD 10 to 50 million

Sources:

Sources: i) EAIF.com [accessed: 29/09/20], ii) Allianz, Allianz finances African infrastructure projects by investing into Emerging Africa Infrastructure Fund (EAIF) (2018), iii) Pilling, Allianz makes $120m investment in African infrastructure (2018), iv) IFU, DFI blended concessional finance working group join report (2019)