The Emerging Markets Loans Fund (EMLF) extends socially and environmentally responsible senior loans with fixed maturity dates to financial institutions, renewable energy firms and agribusinesses. Institutional investors benefit from the experience and track record of the development finance institution (DFI) which manages the fund, as well as a diversified portfolio.

Geography: All emerging

Size: USD 272 million (raised) USD 750 million (target)

Impact thesis: Multiple Sustainable Development Goals (SDGs)

Fund manager: FMO Investment Management (assets under management, AUM, EUR 600 million) and NN Investment Partners (NN IP, AUM EUR 285 billion)

- FMO Investment Management, a subsidiary of FMO, the Dutch entrepreneurial development bank (total AUM 10.4 billion), and NN IP jointly manage EMLF

- FMO has invested in emerging markets since 1970, with its portfolio of investments now spanning 85 countries

- NN IP is a Dutch asset manager with a historical presence in emerging markets, offering an emerging markets debt hard currency strategy to institutional investors since 1993

- EMLF follows FMO’s SME Finance Fund which similarly extended debt financing to financial institutions in developing countries

Investment overview

| Key fund limited partners (LPs) / Investors | Alecta (50%), NN Life Insurance Co. Ltd. |

| Other investors | IMAS Foundation and undisclosed investors |

| Minimum investment | EUR 5 million |

| Instrument type | Debt fund (other) |

| Average investment size in portfolio companies | Bilateral loan commitments USD 5-10 million Syndicated loans USD 50-300 million |

| Time horizon | 15-year closed-end fund, possibility to extend by two years |

Financial return profile

Returns: Market-rate

- Target gross returns USD 6-month London Interbank Offered Rate (LIBOR)

- +4-5%, adjusted for impairments / write-offs (net returns unavailable)

- Gross returns 4.78% per annum since inception

Track record:

- FMO representative loan portfolio annual gross returns of USD 6-month LIBOR + 4.4% 2009-2017

Liquidity:

- 15-year closed-end fund, possibility to extend by two years

- Weighted average life (WAL) around 2.7 years

- Quarterly dividends

Risk profile

Currency risk: Lending in USD and EUR, no currency hedging

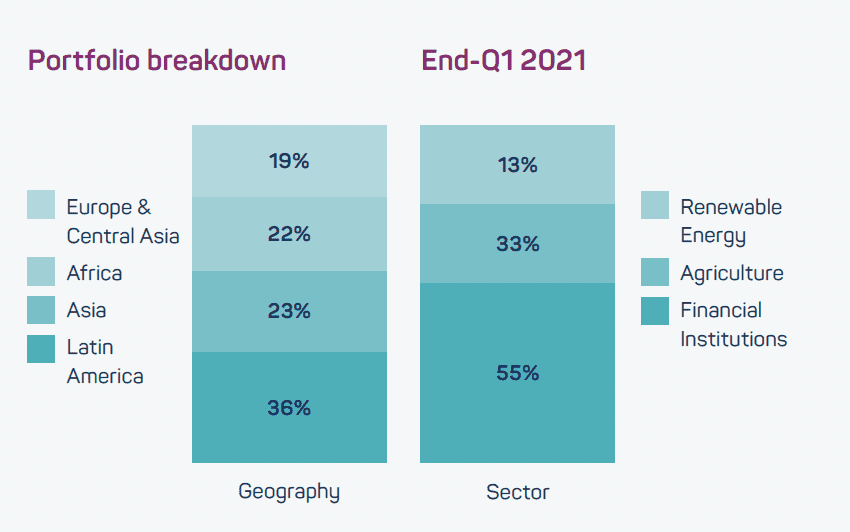

Political risk: Maximum portfolio share 40% per region, 15% per country

Execution risk: On-site due diligence, regular site visits

Concentration risk: Portfolio share <5% (maximum USD 25 million) per single holding

Risk mitigation:

- FMO co-invests on average around 40% capital to portfolio loans

- 50% of portfolio is secured loans and all loans are senior

Investment thesis

A scarcity of long-term funding opportunities for private firms in emerging markets offers attractive returns for lenders, such as FMO, capable of selecting the best projects and companies

With a portfolio spanning 85 countries, FMO offers a strong pipeline of deals which are transferrable to the fund

Carefully-selected emerging market private debt offers a yield pick-up and more stable returns than equivalent public debt (measured by JP Morgan indices)

EMLF is sub-participant in loans issued by FMO so benefits from transfer and convertibility risk mitigation due to de facto preferred creditor status of FMO as a development bank

Investment selection

Eligible investments

EMLF has long-term buy-and-hold strategies, investing in the following sectors:

- Financial institutions

- Renewable energy

- Agribusiness, including food and water

Due diligence process

Screening: Analysis / monitoring of firm transactions and on-site due diligence

Credit rating: Rating assigned by model developed by Moody’s, borrower must have minimum B rating at investment start

Monitoring: Financial / non-financial covenants allowing early action in the event of financial distress / failure to meet Environmental, Social and Governance (ESG) criteria

Impact targeting

Impact thesis

Theory of change:

- EMLF allows emerging market firms access to credit, generating growth and reducing poverty

- Environmentally responsible investments reduce greenhouse gas (GHG) emissions, lessening the burden on communities disproportionately affected by climate change

Target stakeholders: Emerging market Small and Medium-sized Enterprises (SMEs) and communities

Impact metrics and outcomes

EMLF reports target SDGs for every loan in quarterly strategy briefs and reports three fund-level impact metrics. Latest outcomes across the metrics include:

- Number of jobs supported: 9,190 (including full time employees and indirect jobs created)

- GHG emission avoided: 25,195 tons of carbon dioxide equivalent (tCO2eq) (difference between expected GHG emissions of company / project vs. most likely alternative based on independent, verified data)

- Financed emissions: 84,104 tCO2 eq (indicates the green house gas emissions equivalent of tCO2 measured for all investments in the portfolio)

Representative project investee spotlights

Lubilia Kawembe Hydropower, Uganda

Hydropower plant – Renewable energy

FMO extended senior debt financing in 2018 to the 5.4-megawatt Lubilia Kawembe river hydropower

project in the Rwenzori Mountains, Uganda, contributing to a total USD 10.2 million senior loan facility.

The electricity produced has the potential to serve 274,168 people and has an annual avoided GHG rate of approximately. 11,880 tCO2 eq. As of 2018, FMO had financed 12 clean energy projects in Uganda totaling 359 megawatt (MW) with commitments totalling over USD 150 million.

ECOM, Nigeria

Supply chain manager – Agriculture

Since 2012, FMO has extended debt finance to ECOM, a supply chain manager with experience in over 40 countries. ECOM used these loans to establish long- term sustainable supply chains with smallholders in

coffee and cocoa producing countries and to reduce the environmental impact of its processing operations.

These projects included the installation of a solar panel field in its cocoa bean processing facility in Nigeria which cut the plant’s use of fossil fuel power by half.

Institutional investor spotlight

Alecta

Investment: USD 200 million

Alecta, a Swedish pension fund managing assets worth USD 99 billion, made an anchor commitment of USD 200 million to EMLF in 2018. Alecta applies environmental, social and governance standards to all of its portfolio companies.

“To us, this is a good example on how we can fulfil our duty to create the highest value possible for the occupational pensions, as the fund meets both the required rate of return and creates measurable impact aligned with the 2030 Agenda for Sustainable Development Goals.”

Magnus Billing, CEO, Alecta

“The fund meets our required rate of return while delivering measurable impact, and also gives us exposure to a market we could not get access to with our in-house capacity.“

Alecta spokesperson

Other similar opportunities in the market

EMLF is one of four private loan funds managed by FMO including:

- FMO Privium Impact Fund (USD 157 million) focused on climate change and job creation

- ACTIAM-FMO SME Finance Fund (EUR 150 million) focused on financing SMEs in emerging markets as the ‘missing middle’ of the growth economy

Key observations for institutional investors

Experienced partners can identify investment piplines which generate high, stable returns

- Development finance institutions with extensive market experience can identify and effectively screen the best projects and companies for emerging market impact investments, generating high and stable returns

- With a portfolio spanning 85 countries and strong local networks, FMO can identify an extensive pipeline of opportunities which are likely to generate high returns

Development finance institution fund manager co-investment mitigates risks

- Co-investment by development finance institution fund managers ensures alignment of interests, mitigates risks and ensures that private partners are incentivised to pursue high returns

- FMO co-invests around 40% capital to EMLF portfolio loans on average. EMLF benefits from transfer / convertibility risk mitigation due to de facto preferred creditor status of FMO as a development bank

Robust due diligence processes mitigate project risks

- Thorough due diligence and ongoing monitoring / evaluation can enable faster intervention by fund managers to mitigate projects risks

- FMO integrates financial and non-financial covenants into due diligence documentation and conducts regular on-site visits allowing early action when facing investee financial distress or failure to meet ESG criteria

Experienced partners offer diversification opportunities

- Development finance institutions with experience in frontier markets offer access to assets in countries that have limited overlap with emerging market bond markets, offering diversification for emerging market portfolios

- FMO invests in frontier markets that have relatively low correlation with traditional emerging market debt portfolios

Sources:

Sources: i) Rust, Alecta anchors first close of emerging markets impact fund (2018), ii) ImpactAlpha, Swedish pension fund adds $100 million to Dutch SDG-loan fund (2018), iii) pionline.com, Alecta puts another $100 million with emerging markets loan fund (2018), iv) pionline.com, Sweden’s Alecta starts ESG pressure campaign (2020), v) Symbiotics, The Financial Performance of Impact Investing Through Private Debt 2nd Edition (2019) , vi) Symbiotics, The Financial Performance of Impact Investing Through Private Debt (2018)