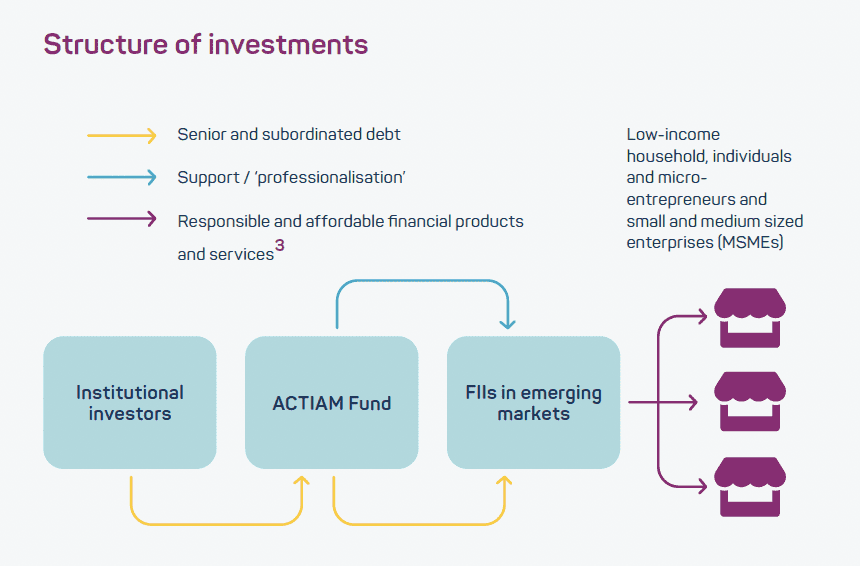

The Financial Inclusion Fund (formerly Institutional Microfinance Fund III) is the third-generation financial inclusion fund offered by ACTIAM and Developing World Markets (DWM), raising debt capital from institutional investors to provide financing to financial inclusion institutions (FIIs) across emerging markets, with expected market-rate returns. Investments are de-risked through ACTIAM’s FII selection approach and active support to FIIs.

Geography: All emerging

Size: Around EUR 114 million (raised)

Impact thesis: Financial inclusion

Fund manager: ACTIAM

Total assets under management (AUM): Around EUR 22 billion

- ACTIAM is an asset manager established in 1997 and based in the Netherlands

- It manages around EUR 22 billion in total, of which EUR 875 million is committed to impact investments, with a particular focus on financial inclusion through its three generation micro-finance funds

- ACTIAM has also launched a fund focused on Small and Medium-sized Enterprises (SMEs), in partnership with FMO, the Dutch entrepreneurial development bank

Investment overview

| Key fund limited partners (LPs) | Institutional investors, including pension funds and insurance companies, foundations and family offices, from the Netherlands, Spain and Italy |

| Instrument type | Commercial debt fund (microfinance) |

| Time horizon | (Semi) open-end fund structure |

| Fee structure | Between 1.25%-1.05% management fee, depending on the fund’s total NAV size |

Financial return profile

Returns: Market-rate

- Fund I and Fund II generated 5.5% and 4.0% internal rate of return (IRR) per annum, as of end-September 2021, outperforming the Symbiotics Microfinance Index (SMX) debt euro index of similar FII funds1

- Current IRR: 3.9% as of end-September 2021 (reflecting the impact of the coronavirus pandemic)

Liquidity:

- Illiquid private investment

- Buy-and-hold strategy providing limited liquidity, due to (semi) open-end fund structure

Risk profile

Credit risk: Unrated with an implied rating between BB and BBB, driven by very high repayment rates achieved by FIIs

Currency risk: Local currency exposures are hedged or cross-hedged and further mitigated by a strong diversification in investments in multiple currencies

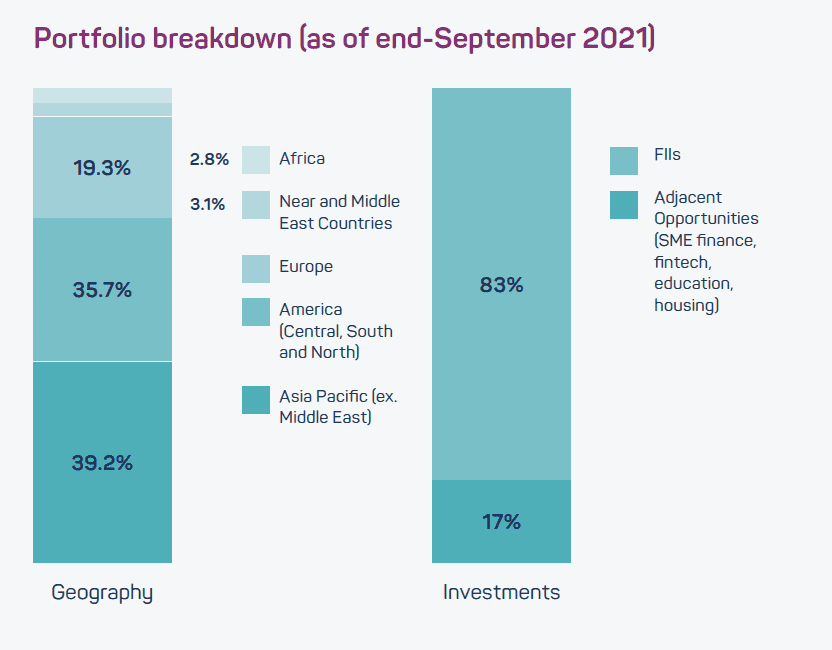

Concentration risk: Exposure to 50 FIIs in 27 countries

Investment thesis

Detailed selection process and support to FII professionalisation:

- Funds I and II outperformed the SMX debt euro index of similar FII funds

- ACTIAM and DWM attribute the outperformance to the unique model they operate[2], competitive ongoing charges and an effective hedging policy

Investment selection

Eligible investments

The initial screening is based on a set of both financial and social criteria. To be eligible for funding a company should meet the following criteria:

- Financially sustainable FII (tier 1 and tier 2)

- Based and operating in emerging or frontier market(s)

- More than 50% of gross loan portfolio (GLP) comprises micro-loans and/or more than 50% of client base is comprised of micro-entrepreneursEndorsed the Universal Client Protection Principles

- Complying with ACTIAM Fundamental Investment Principles

On impact criteria, DWM screens FIIs based on an annual Social Impact Questionnaire and Scorecard with five dimensions, each weighted differently:

- Client benefit and welfare (40%) – low default rates

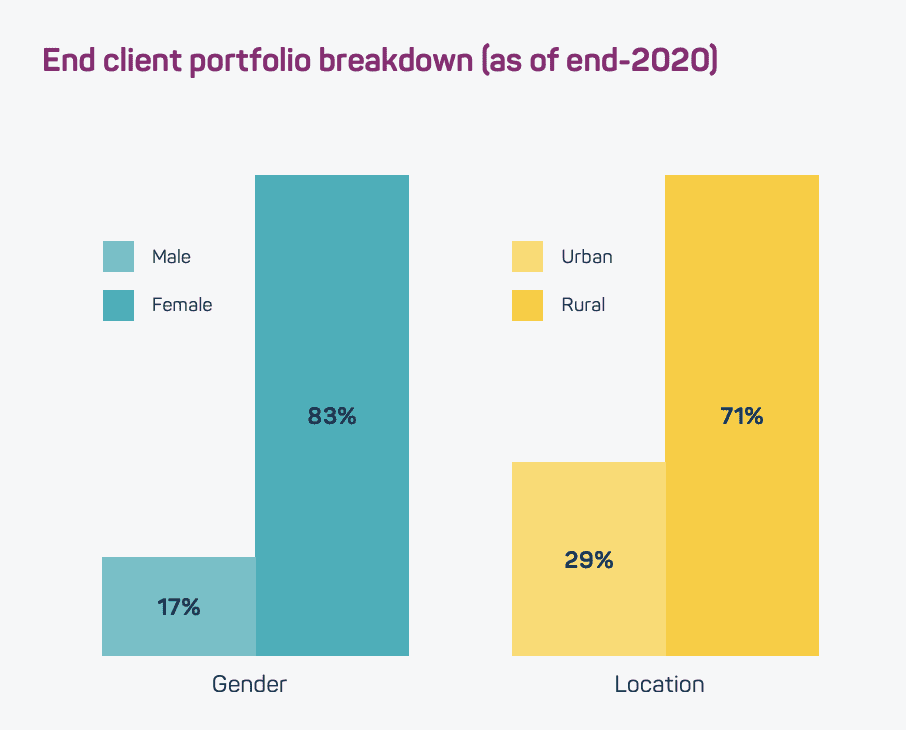

- Outreach and targeting (25%) – focus on women and rural clients

- Governance (20%) – professionalism, operations and reporting

- Responsibility to community and staff (10%) – internal policies

- Environmental impact (5%) – environmental policies

Due diligence process

In addition to the scorecard, DWM performs thorough due diligence on each FII prior to investment, including desk research, financial review and visit to a sample of micro-, small- and medium-sized enterprise (MSME) clients. DWM makes a recommendation to the investment committee, as part of an ongoing interactive process with the IC.

Impact targeting

Impact thesis

Theory of change:

- The fund provides financing to FIIs

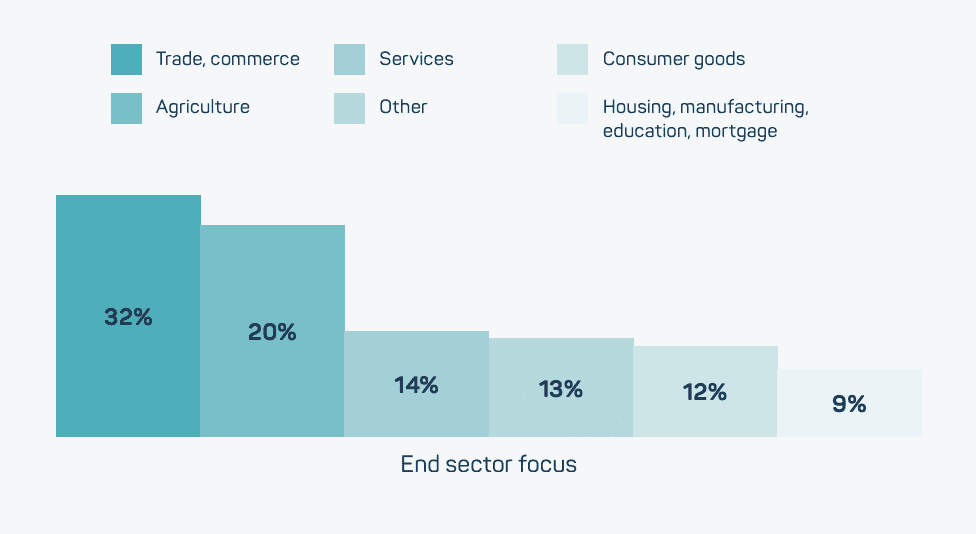

- FIIs are able to offer financial products and services (saving deposits, micro- credits, insurances) to MSMEs and low-income individuals and households

- Micro-entrepreneurs and SMES have access to micro-loans to grow their businesses that ultimately stimulate local economic growth and increases in incomeLow-income households have access to financial services enabling them to smoothen their incomes, access basic services, recover from setbacks and build resilience

- The fund also makes additional investments in adjacent sectors to improve the FII’s performance and deepen social impact

Target stakeholders:

- Micro-entrepreneurs

- SMEs

- Low-income individuals and households

Impact reporting mechanism

The fund monitors its financial and social performance regularly and provides monthly financial updates to investors. Social performance is measured through an annual Social Impact Questionnaire and Scorecard, assessing the FIIs on 50 indicators, including:

- Access to finance: Number of customers who have been reached by relevant financial products offered by the partnering FIIs (currently 8 million)

- Client services: Support and improvement of clients’ financial literacy, through non-financial support (e.g. literature, educational materials, fintech solutions, etc.)

- FII organisational development: Improvement of the quality of operations and financial and non-financial reporting, gender equality and client protection

Institutional investor spotlight

SPF Beheer

SPF Beheer (now Pensioenfonds Rail & Openbaar Vervoer) was the pension provider for the Dutch Railway Pension Fund and the Public Transport Pension Fund. SPF Beheer managed EUR 21 billion in assets, with a strong commitment to socially responsible investments, driven by clients.

Following the success of its investments in the Institutional Microfinance Fund, SPF Beheer also invested in the ACTIAM-FMO SME Fund, which aims to support the growth of SMEs in emerging markets.

“More than 2 billion people do not have bank accounts. By investing in the Financial Inclusion Fund, you increase the low-income group’s access to financial services, such as savings and small consumer credits. Such loans to small business owners and households have proven to be drivers of economic growth and employment. At the same time, it is a valuable alternative in the search for yield.”

Theo Brouwers, Head of Impact Investing, ACTIAM

Portfolio investee spotlight

CASHPOR micro credit, India

FII – Financial inclusion

CASHPOR is an FII operating across five states in India through 639 branches. It finances almost one million borrowers, mainly agricultural labourers living in the economically marginalised northern states. The FII has a strong impact focus, as its mission is to identify Below Poverty Line (BPL) women in rural areas and deliver financial services to them to help them lift themselves and their families out of poverty.

CASHPOR formed a partnership with the Financial Inclusion Improves Sanitation & Health programme (FINISH) in 2012 to upgrade sanitation facilities in its operational areas.

The Financial Inclusion Fund provided, as part of a pilot, CASHPOR with a three-year loan in 2019 with an impact target to add 35,000 toilets to upgrade sanitation facilities in underserved areas. The loan included an outcome-based interest rate discount to stimulate CASHPOR to realise the impact targets.

The pilot has been a success as 83% of the target has been realised and approximately 144.250 household members have benefited from improved sanitation facilities.

Other similar opportunities in the market

- ACTIAM Financial Inclusion Fund is open for new participants

- Alongside this fund, ACTIAM also operates an SME Finance Fund, in partnership with FMO, the Dutch entrepreneurial development bank, targeting financial organisations who finance “the missing middle”, or small and medium growth stage borrowers

- Across emerging markets, microfinance funds have seen increased investment from institutional investors: several fund managers have launched funds that identify and provide debt lending to FIIs in emerging markets, including BlueOrchard, Symbiotics, MicroVest, OikoCredit and GroFin, among others

Key observations for institutional investors

Financial inclusion has a proven track record both in making market-based financial returns and enabling social positive impact with a sound risk-return profile

- Repayments in the microfinance space have proven to be particularly high and consistent – microfinance programmes across the world have extremely high repayment rates at around 95% to 98%, through group lending tools and the high commitment of borrowers to repay

- ACTIAM works closely with FIIs to effectively manage their ‘at risk’ portfolios and maintain these high repayment rates

Proven investment managers have a successful financial and impact record in this sector

- Launching its third-generation fund, ACTIAM is now one of the most established players in the field, having developed a a financial and social track record of over 14 years for this model

- The long history of the sector and experience of fund managers has resulted in highly efficient and low- cost ways to direct capital to underserved client groups

The COVID-19 pandemic has let to a micro-credit crunch, making these investments particularly impactful

- The current COVID-19 pandemic has significantly increased demand for microfinancing in emerging markets, as individuals and businesses are hit by the effects of closures and shrinking economies

- Sector actors are working with FIIs to provide emergency financing to these individuals, but resources are far from sufficient

- Investing in the FII space during this time is therefore particularly impactful to the survival of MSMEs around the world

Sources:

- The SMX debt euro index is composed of specialised euro denominated microfinance funds holding mainly debt investments

- The fund has a unique model whereby the Investment Advisor, Developing World Markets (DWM), is responsible for the deal sourcing and ACTIAM is responsible for the portfolio management of the fund. The ACTIAM Impact Investing Investment Committee (IC) is ultimately responsible for all investment decisions made for the fund. The IC is an added governance instrument assuring that interests of investors in the fund are optimally serviced from an investment, impact and risk management

- Including income generating loans, savings, payment and insurance products perspective.