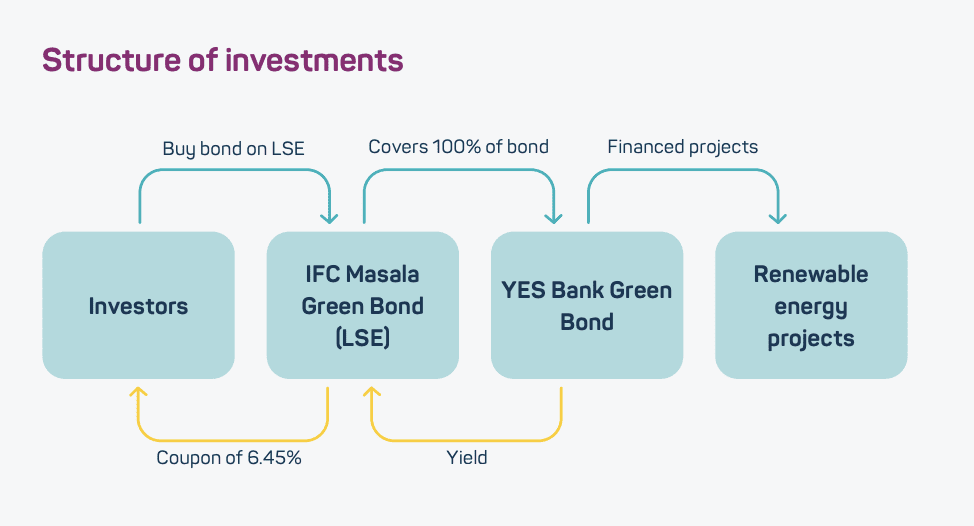

The Masala Green Bond is a public Indian rupee offering listed on the London Stock Exchange (LSE) offered by the World Bank Group’s International Finance Corporation (IFC).

The offering is used to finance a local green bond by YES Bank for renewable energy projects in India. The bond received multiple awards for its structure, including from Environmental Finance and the Climate Bonds Initiative, and has been rated AAA.

Fund manager: IFC & YES Bank

The International Finance Corporation (IFC) is the private-sector arm of the World Bank Group, working to advance economic development through for-profit and commercial projects. As of December 2020, IFC has issued 178 green bonds for over USD 10.6 billion.

YES Bank is one of India’s largest commercial banks, headquartered in Mumbai, with presence in all 29 states and in seven union territories. The bank manages over USD 25 billion in assets. Since 2015, it has issued three green bonds working with IFC and FMO, the Dutch entrepreneurial development bank, for a total of USD 260 million.

Investment overview

| Key fund limited partners (LPs) / Investors | Japan’s Government Pension Investment Fund (GPIF) investing across IFC green bonds |

| Time horizon | 5 year maturity |

Returns profile

Returns: Market-rate

- 6.45% coupon, 5 year maturity

Track record: IFC has issued 177 other green bonds with predictable and stable returns in 20 different currencies

Liquidity: Liquid asset

- The London Stock Exchange, where the bond is listed, is highly liquid as the second largest stock market in Europe

Risk profile

Regulatory risk: The bond is listed on the London Stock Exchange regulated market

Credit risk: The IFC bond issuance is rated AAA and has been successful in attracting new investors to the Indian rupee market

- Currency risk: Denominated in Indian rupees, although investors can purchase IFC green bonds in multiple (20) other currencies for diversification

Investment thesis

This was the first offshore Indian rupees bond issuance funding investment into a local corporate green bond. IFC’s role had two key effects:

- IFC’s listing on the London Stock Exchange makes the bonds accessible for foreign investors, and de-risked the offering with its AAA rating and significant local knowledge and expertise.

- IFC commits to assessing YES Bank’s pipeline of green investments, guaranteeing that the use of proceeds will meet the IFC’s Green Bond eligibility criteria, rigorous project due diligence will be conducted and reporting will be externally verified.

Investment selection

Eligible investments

IFC Green Bond selection criteria include the following:

- Use of proceeds meets IFC’s Definitions and Metrics for Climate-Related Activities (incl. enabling renewable energy, reducing the use of energy per unit, supporting sustainable forestry and more)

- Projects comply with IFC’s standards for environmental and social issues

- The project team meets IFC’s corporate governance framework

The criteria are externally reviewed by the Centre for International Climate and Environmental Research at the University of Oslo (CICERO).

Due diligence approach

Any project financed through an IFC Green Bond undergoes a rigorous due diligence process to ensure they meet the IFC’s standards in several areas, including:

- Labour working conditions and safety of staff and communities

- Land acquisition and involuntary resettlement

- Biodiversity conservation and sustainable management of resources

- Resource efficiency and pollution prevention

Impact targeting

Impact thesis

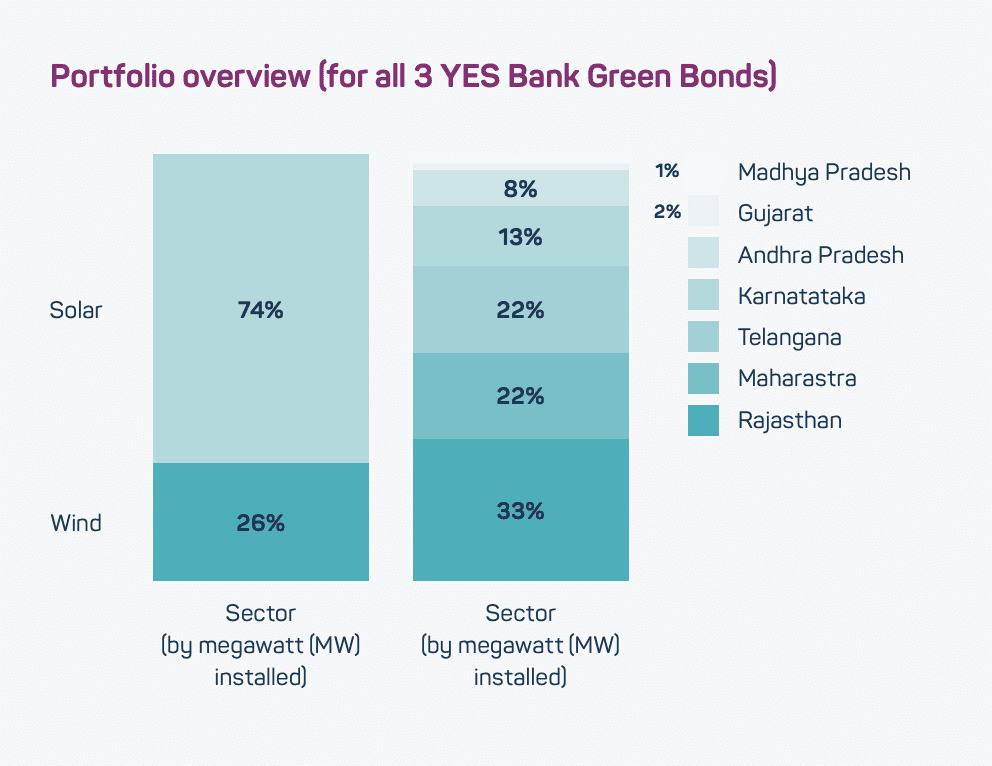

Theory of Change: The IFC bond allows foreign institutional investors to support the long-term financing needed for projects involving climate change. In this case, it is supporting YES Bank’s commitment to the Indian government to fund 5000 megawatt (MW) of renewable energy projects by 2020, through financing wind and solar projects to replace fossil fuel use.

Beneficiaries: Underserved communities accessing renewable energy and the general Indian population mitigating the effects of climate change.

Impact metrics and outcomes

Individual projects are monitored on standard metrics:

- Electricity generated: megawatt hour (MWh) of electricity generated

- Greenhouse gas emissions avoided (CO2, SO2, oxides of nitrogen)

- Fossil fuel usage avoided through solar and wind replacement

- Households connected amongst previously underserved communities

Portfolio investee spotlights

Azure Power – Solar PV technology

Renewable energy

- Azure Power is a leading provider of solar photovoltaic energy technology in India. Azure is scaling solar capacity at three of its plants in Punjab, Andhra Pradesh and Telangana by up to 225 gigawatt hours (GWh) per year.

- Azure received USD 31 million in financing from IFC / YES Bank’s Green Bond and syndication of parallel loans of up to USD 80 million.

- As a result, the project will help avoid greenhouse gas emissions, reducing approximately 181,895 tons of C02 per year.

Wind and solar investments with the European Investment Bank – multiple companies

Renewable energy

- YES Bank has joined up with the European Investment Bank to manage a new co-financing program for construction of new solar power plants and wind farms across India.

- Eligible solar projects have been identified in the states of Rajasthan, Telangana, Maharashtra and Karnataka and additional wind and solar projects are being examined.

Institutional investor spotlight

Japan’s Government Pension Investment Fund (GPIF)

Investment: More than USD 500 million across the portfolio

GPIF is one of the world’s largest pension funds, managing USD 1.6 trillion in assets. GPIF has been a long-standing partner of the World Bank and IFC on green bonds, having invested more than USD 500 million into these instruments.

In 2017, the World Bank and GPIF formalized an agreement to direct more capital towards ‘sustainable investments’ on public bond markets, including collaboration on strategies to research how Environmental, Social and Governance (ESG) factors impact risk and financial returns in fixed income markets and convening conversations with investors to promote more investments.

“We regard investments in Green, Social and Sustainability Bonds as direct methods of ESG integration […] We are committed to promote ESG to ensure the sustainable performance of the pension reserve fund for all the generations.”

Hiro Mizuno, Former Executive Managing Director and Chief Investment Officer, GPIF

Other similar opportunities in the market

- Financial institutions including development finance institutions are the largest category of bond issuers targeting emerging markets, representing 59% of all bonds.

- The IFC Green Bond Program has issued 178 green bonds for over USD 10.6 billion

- The African Development Bank (AfDB) Green Bond Program, launched in 2013, has allocated around USD 4 billion to 48 green projects around Africa

- The European Investment Bank (EIB) has issued EUR 18 billion in climate awareness bonds

- Development finance institutions also work closely with sovereign and corporate bond issuers to help structure and verify their bond issuances or to directly invest in them:

- IFC has supported emerging markets governments to structure their own local currency green bonds, in Indonesia, Fiji, the Philippines and other countries

- AfDB has supported several corporate green bond issuances across Africa, including recently investing in NedBank’s green bonds offering on the Johannesburg Stock Exchange

Key observations for institutional investors

Emerging markets green bonds are often listed on developed market stock exchanges

The IFC Masala Green bond offers international investors access to a local currency bond on the London Stock Exchange, opening up the opportunity to diversify their portfolio in emerging markets within a highly regulated and liquid environment.

“Listing local currency green bonds in London allows us to attract the widest possible range of international investors”

Jingdong Hua, Vice President, IFC

Development finance institutions are de-risking local green bond offerings

The YES Bank green bond achieved an AA+ rating from Indian rating agencies ICRA and CARE

However, IFC’s re-issuing of the bond allowed the instrument to become an AAA rated-issuance, linked to IFC’s strong track record and large balance sheet

In this structure, IFC carries the exposure to the local YES Bank’s investments, rather than passing this onto the investors directly

Development finance institutions also provide credibility to a bond’s impact profile

IFC’s involvement signals to investors that the use of proceeds is verified by an experienced and rigorous institution, meeting international standards for green bonds.

IFC also imposes transparent reporting and monitoring on project investments, ensuring accurate data is captured.