We spoke to George Graham, Director at the South Yorkshire Pensions Authority to compile the information in this case study.

Fund facts

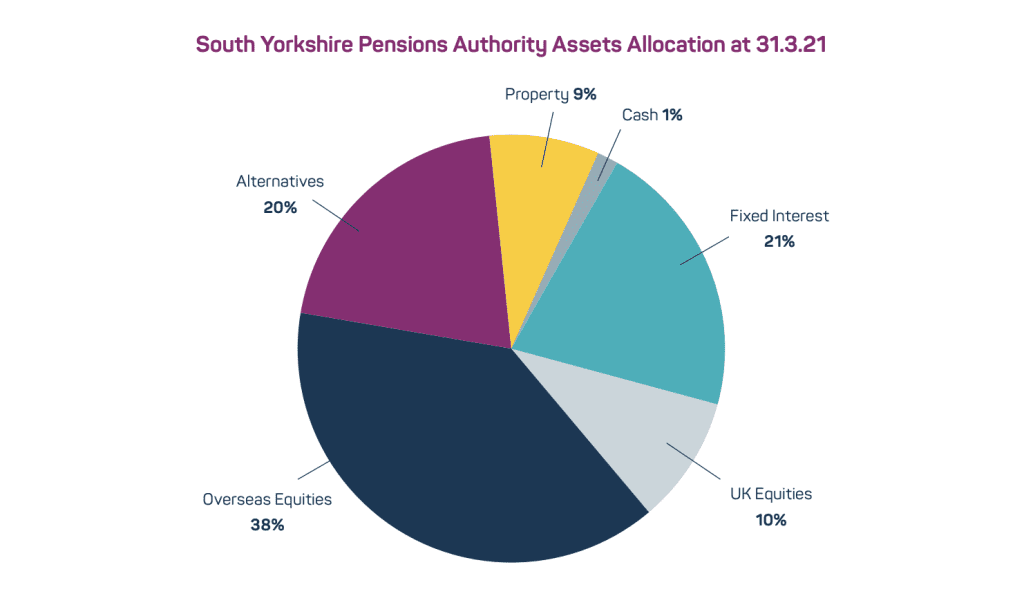

£9.9bn

Assets under Management (AUM) (March 2021)

99.9%

Funding level (March 2019)

Valuation estimated 108% at March 2021

533

Employers represented (March 2021)

166,869

Number of members (March 2021)

Impact journey facts

- Ultimate aim of up to 5% allocation to impact investments

- Focused on detailed mapping of SDGs 6, 7 and 13 but with a wider review of all 17 SDGs

- Achieve net zero by 2030

- Existing allocation of 1% of the fund to place based investment in South Yorkshire with a focus on real world outcomes such as reuse of redundant buildings and the creation of new affordable homes.

How did you get buy in for impact investment from trustees?

The Board and the Committee viewed impact investment as a natural progression and instead of having to achieve buy in it was more about where to look for sustainable returns and how to measure impact. Councillors on the Pensions Authority have wanted to see a more impactful focus and a more local focus to some elements of the portfolio since at least 2015, when elements of the Real Assets portfolio began to be directed towards funds focussed on issues such as affordable housing. The Institute’s Impact Investing Principles for Pensions provided us with a validated and credible framework based on practical good governance steps.

Why did you choose to use the Impact Investing Principles for Pensions?

Organisations with credibility are behind the Impact Investing Principles. As it is backed by others, it is more likely to be supported as you’re acting in concert.

What has your progress been on each of the Principles?

Principle 1: Set impactful objectives

We are committed to using the United Nations Sustainable Development Goals (SDGs) as a framework for setting and measuring impact. We are focusing on SDG 13 – Climate Action, SDG 6 – Clean Water and Sanitation and SDG 7 – Affordable and Clean Energy. It is possible to make successful investments across the wider range of SDGs, and the Authority will wish to do so where appropriate within the overall investment strategy, but these were the three where members saw a combination of high priority alongside investment potential.

We believe that investing in well governed and sustainable assets is key to delivering the long-term investment returns required by the Pension Fund. Our goal is for carbon emissions from the totality of our investment portfolio to be zero by 2030 (the “Net Zero Goal”) and we have developed a net zero action plan to chart the route to this goal. This action plan includes the incorporation of this Net Zero Goal in the Authority’s investment beliefs and investment strategy and contemplates frequent review of the performance of its investments within the context of this goal, as well as monitoring of the delivery of the commitment and the transition towards it.

Principle 2: Appoint investment consultants and managers with impact integrity

We do not use an investment consultant but we do use independent investment advisers, who help us shape our strategy and review the performance of the Fund. These advisers provide access to wider thinking within the investment world and thought leadership on impact investing. The advisers provide second opinions on investments, where appropriate, in order to understand performance and the asset allocation mix. We also use consultants to support us with specific pieces of work, for example in understanding the impact of our whole portfolio in terms of the SDGs.

Principle 3: Use your voice to make change

We do not have our own stewardship policy but we do adhere to the Stewardship Code. We have adopted our LGPS pool’s collective voting policy which we have contributed to developing, but we will be incorporating our impact objectives into the next responsible investment policy review in the second half of 2021 to ensure alignment. We use a third-party data service provider to collect data and information in relation to impact reporting.

As part of our investment beliefs, we expect those managing money on behalf of the pension fund to reflect these factors in their investment process and where specific risks or concerns are identified to engage with assets to ensure that these characteristics are met. Engagement activity will:

- Have clear and specific objectives;

- Be time limited;

- Where unsuccessful link to clear consequences reflecting the degree to which the investment thesis for the asset has been undermined by non- compliance.

Principle 4: Manage and review your impact

We use a range of different tools to measure and assess impact including reporting according to the Taskforce for Climate- related Financial Disclosures climate change scenario analysis to inform progress in relation to our net zero ambitions.

We will report each year on the impact of our investment portfolio on society using the framework of the UN Sustainable Development Goals with reference to SDGs 6, 7 and 13. At the time of writing our first report is being worked on and how we gauge the impact that our investments are having on each SDG is likely to be significantly influenced by the type and quality of data we are able to gather from fund managers.