We spoke to Neil Mason, Strategic Finance Manager at Surrey Pension Fund compile the information in this case study.

Fund facts

£5.2bn

Assets under Management (AUM) (July 2021)

110%

Funding level

313

Employers represented

109,000

Number of members

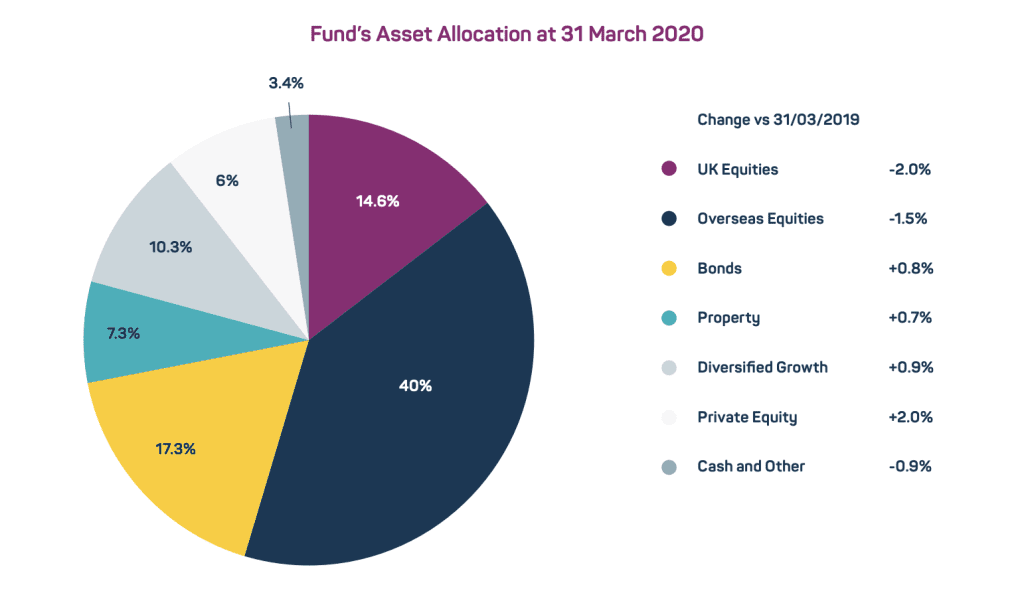

Impact journey facts

- All 17 SDGs mapped

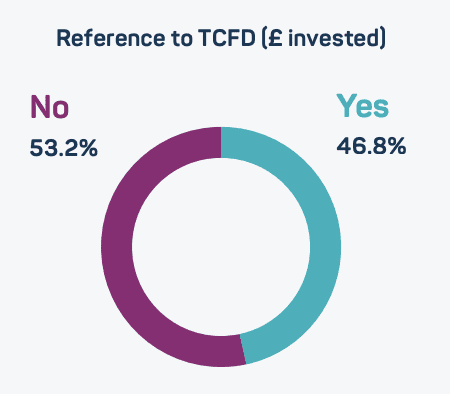

- 53% of fund making meaningful reference to TCFD

- Around 80% of fund invested in companies deemed most likely to deliver the SDGs by 2030

How did you get buy in for impact investment from trustees?

We went through an education and engagement process on impact investing and stewardship that was facilitated and supported by independent advisors, including Pensions for Purpose. We also faced constructive challenge from lobbying groups with regards to divesting from fossil fuels and looking at our climate impact. Finally, the Institute’s Impact Investing Principles for Pensions provided a good governance framework for the pension fund to follow.

Why did you choose to use the Impact Investing Principles for Pensions?

The Impact Investing Principles for Pensions are pitched at the right level as they are achievable. They provided us with support to look at how we wanted to contribute to a sustainable transformation. We would like to see the Principles evolve and continue to push the industry. Our Committee and strategy was built around the basis that well managed funds and companies aligned with the Sustainable Development Goals (SDGs) are going to provide better return on our assets.

What has your progress been on each of the Principles?

Principle 1: Set impactful objectives

Following our training with Pensions for Purpose and after embedding the United Nations Sustainable Development Goals (SDGs), every investment decision we make is through an SDG lens. We are committed to reviewing our contribution to the SDGs on an annual basis.

We are also signatories to the Taskforce for Climate-related Financial Disclosures (TCFD) and will be setting a net-zero target date. We are currently working on our current TCFD report and the ambition of our net zero target will be informed by this. We expect the Pension Fund Committee to make a decision on this in the early part of 2022.

Principle 2: Appoint investment consultants and managers with impact integrity

The decision to pursue impact investment was that of the Investment Committee’s, not a suggestion by our investment consultant. We used separate independent advisers to review our impact goals, including Pensions for Purpose. We are currently in the process of hiring an investment consultant for impact alignment who needs to prove that they are proficient in applying an SDG lens.

Principle 3: Use your voice to make change

A third-party data provider executed an SDG mapping exercise to work out which SDGs we were impacting across our portfolio. They are also helping us to articulate our standalone Responsible Investment Policy. We plan for this to incorportate our Stewardship Policy including how we conduct split voting on pooled assets when necessary, which is particularly important to ensure our impact objectives are implemented.

Principle 4: Manage and review your impact

We are in the early stage of assessing progress and the quality of data at present is immature. We are able to identify negative and positive impacts across listed assets, but for unlisted assets (20% of the portfolio) this is more challenging. Understanding and articulating our vision on impact investing is the biggest achievement to date, the next stage is to implement it.

“Using the World Benchmarking Alliance’s SDG2000 benchmark to measure the Fund’s current starting position with respect to the SDGs, we found that at the end of December 2019, the Fund’s investment managers collectively held 870 (43.5%) of the 2,000 companies in the SDG2000 that are deemed most likely by the World Benchmarking Alliance to help deliver the SDGs by 2030.”

From Surrey Pension Fund’s Annual Report, 2019-20.

“A number of investment risks and opportunities to the Fund were identified within its assets, in relation to the transition to sustainability and a low carbon economy. These would not have been understood if we had not started to review impact investing and the UN SDGs. These risks and opportunities have become known.”

From Surrey Pension Fund’s Annual Report, 2019-20.