Different investor audiences may have different impact framework needs however the below details our current best thinking on how to report on impacts as an LGPS. Over the course of 2021-22 we will be further iterating this approach, and reflecting on how a reporting framework might need to differ contingent on investor type.

How do you report on impact when placed-based impact investing?

- Overall Impact Goal and Narrative – The overarching place-based impact aim that the LGPS fund is trying to achieve.

- Place-Based Impact Objectives – Thematic or sector specific investment objectives that an LGPS fund should align their place-based investments with.

- Theory of Change – How the actions taken by the LGPS fund contribute to the achievement and improvement of positive outcomes.

- Impact Metrics – How the LGPS funds would report on place-based investment impact performance.

- Impact Reporting – A basic impact reporting template.

- Impact Management – The practical tools needed to ensure the potential for place-based impact creation is considered throughout the investment process.

1. Overall Impact Goal and Narrative

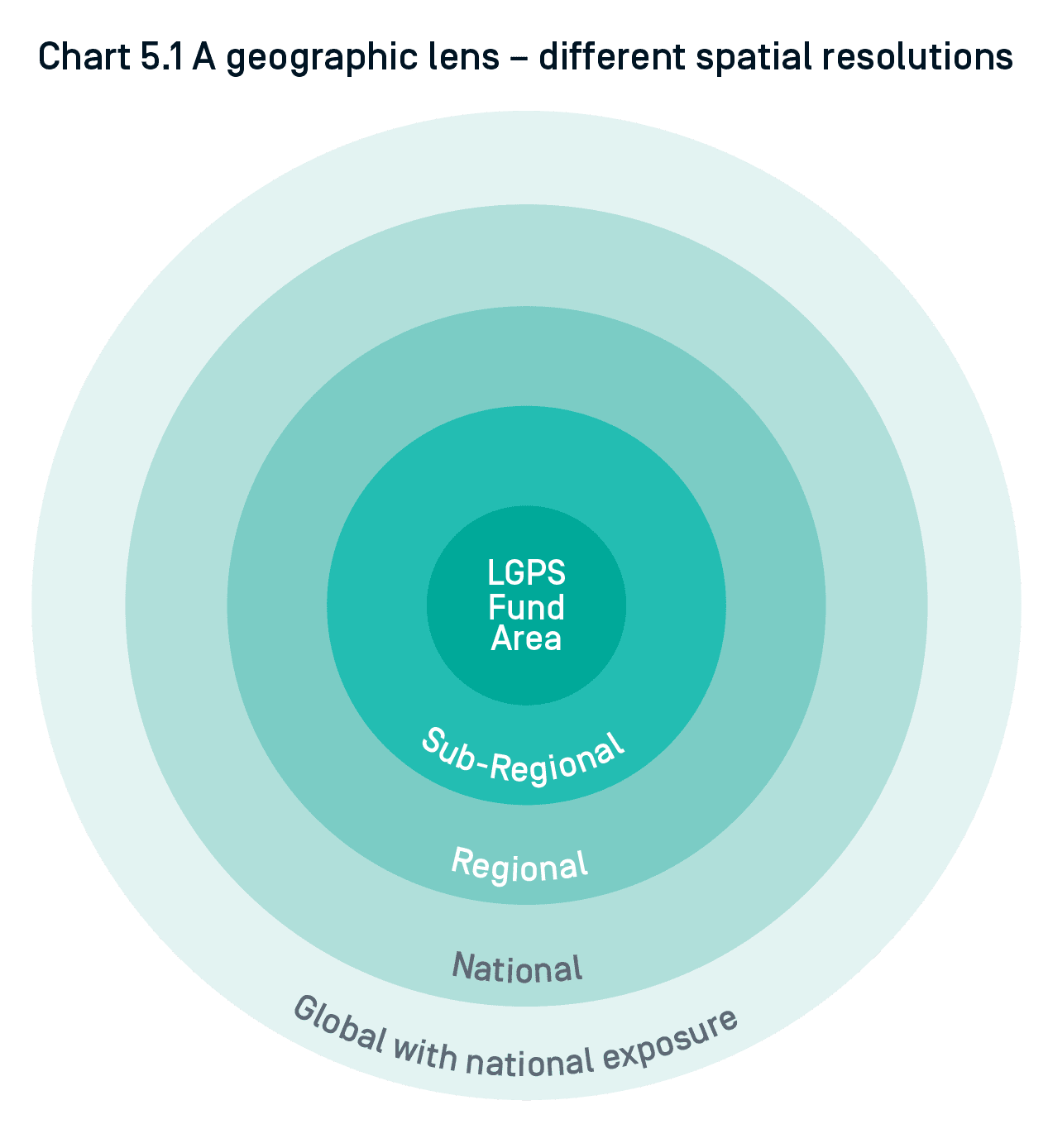

The overall impact goal is a vision statement for place-based impact investing. The purpose of specifying an overall impact goal is to make a statement to help unite the portfolio around a goal against which outcomes can be assessed. This goal can be supported by a narrative that explains the rationale for the Local Government Pension Scheme (LGPS) fund’s commitment to this impact goal and makes clear how it aligns with the LGPS fund’s overall investment philosophy and approach. An LGPS approach to PBII needs to consider the crosscutting nature of place and sector and LGPS funds, and other institutional investors, have varying approaches to the geographic scale of their UK investments. Some are more interested in investments at a UK-wide or national scale (for example the whole of Scotland or Wales), where others are more inclined towards local or regional investment (eg Manchester or the North West of England).

We have used ‘Target Geography’ throughout the approach to refer to reporting at any of these geographical scales. Each LGPS fund must define their own Target Geography. This Target Geography may vary for different sectors. For example, an LGPS fund may be interested in making investments in clean energy at a UK-wide level, while simultaneously wanting to focus on housing investments to benefit deprived local neighbourhoods or underserved populations (e.g. providing social and affordable housing or housing for people who are homeless in the local area).

2. Place-based impact objectives

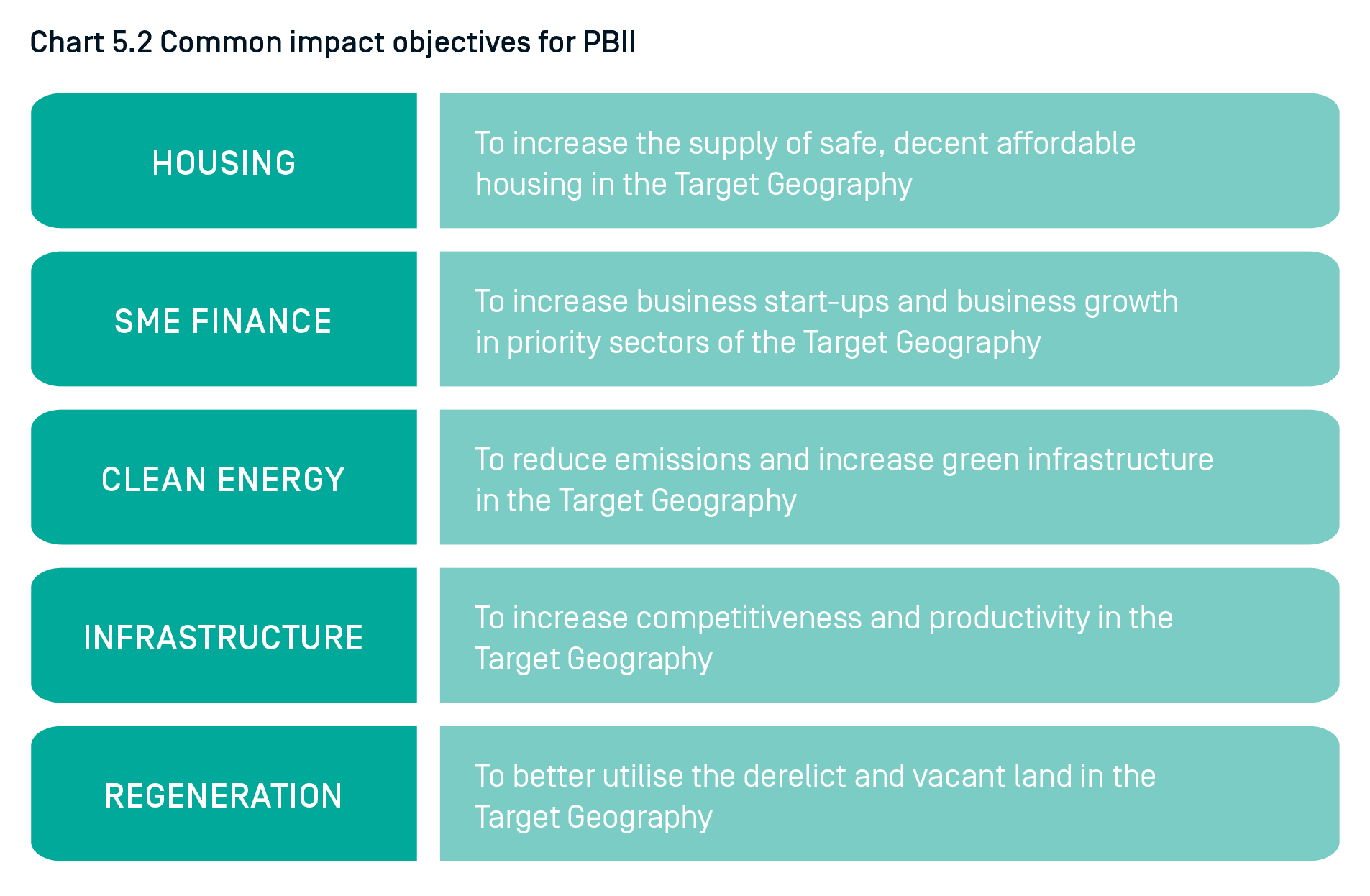

Clear place-based objectives are essential, as they provide the benchmarks against which performance and key results can be measured. For PBII, we recommend setting objectives in consultation with local stakeholders, ensuring that the objectives reflect local development priorities and objective. Special care should be taken to ensure that diverse voices are heard and featured to ensure the success of the impact strategy for example obtaining the insights and views of people of colour, historically unrepresented in investment decisions. Setting objectives in this way helps create a consistent strategy and alignment between the LGPS fund, the local authority and the community beyond. This will also drive consistency of approach across the rest of the value chain – the fund managers and underlying investment opportunities. The Good Economy reviewed the local and regional strategic development plans from a wide range of local and combined authorities to identify impact objectives that align to the five PBII pillars. These objectives are defined in Chart 5.2 below.

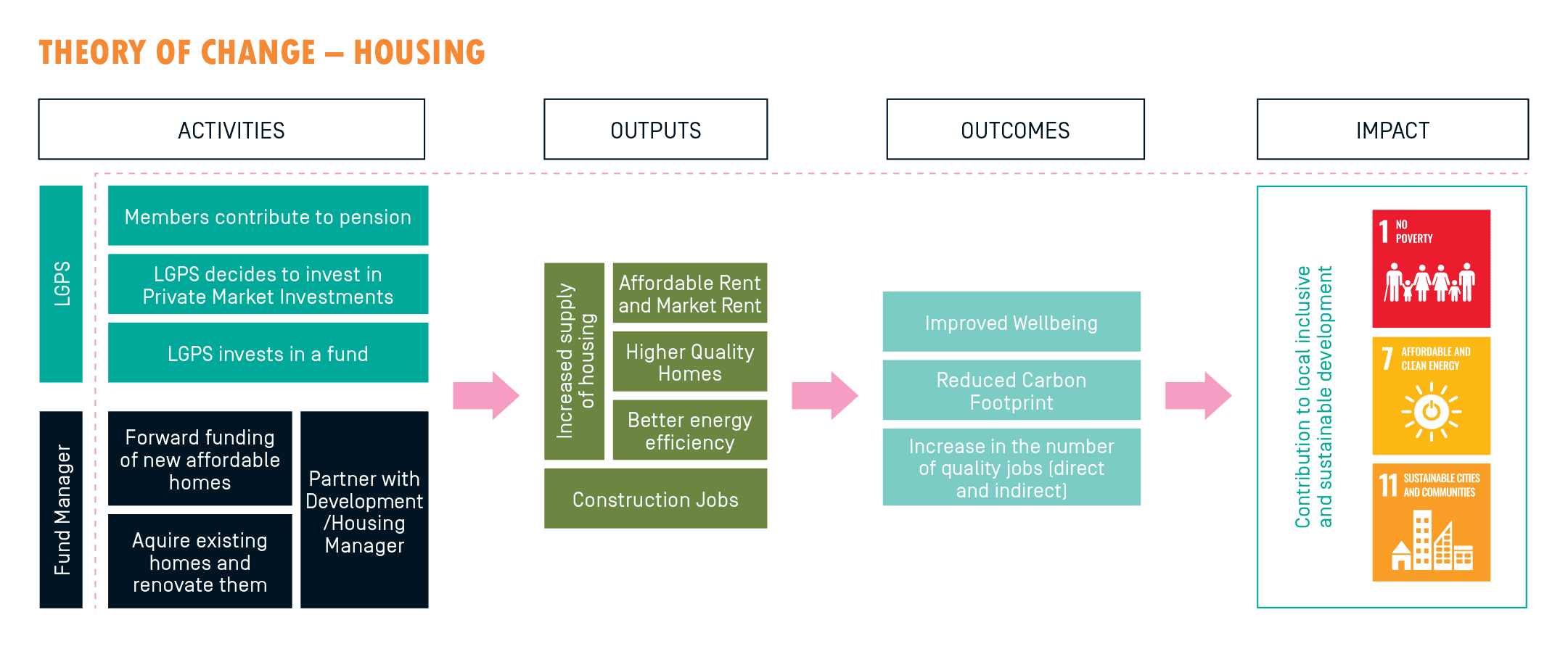

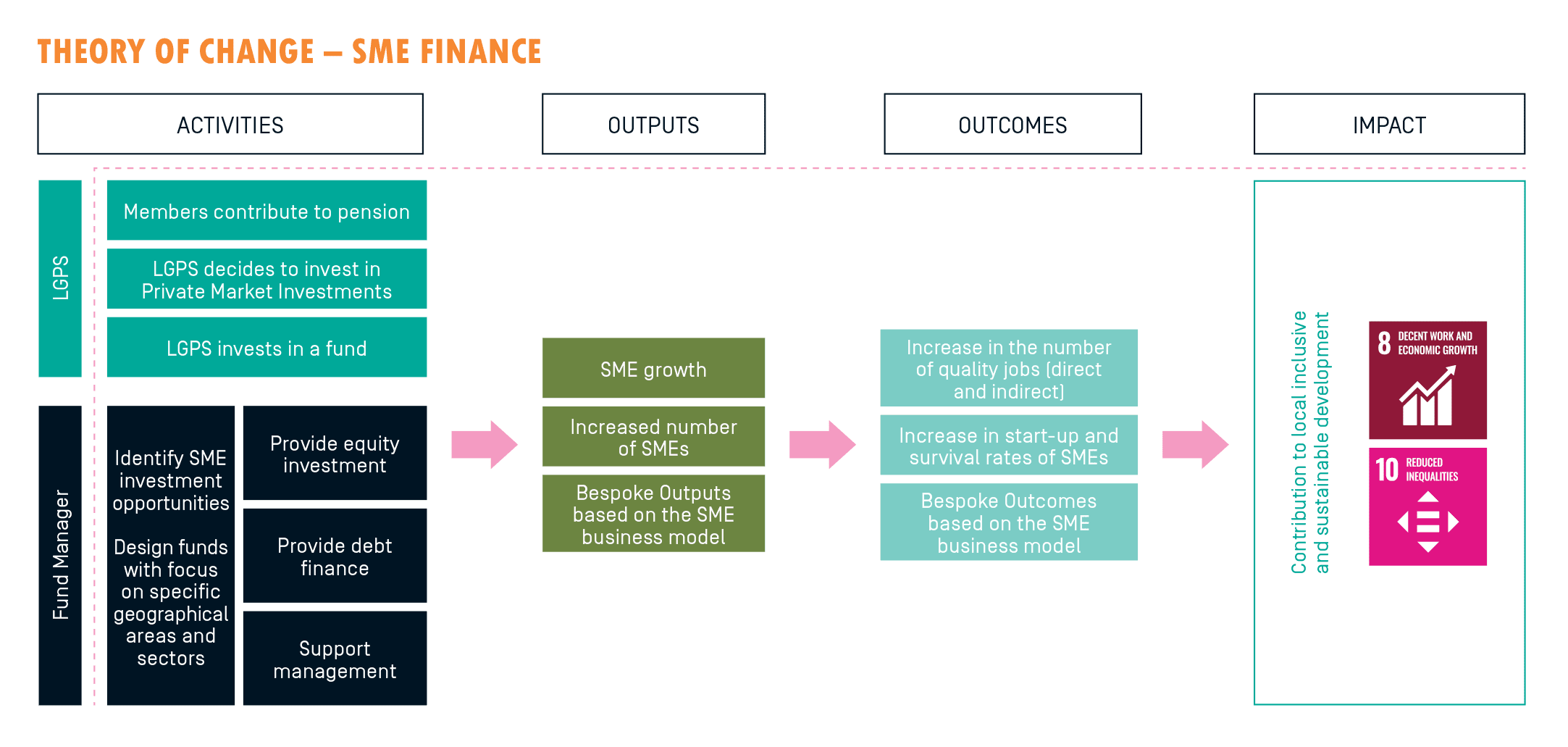

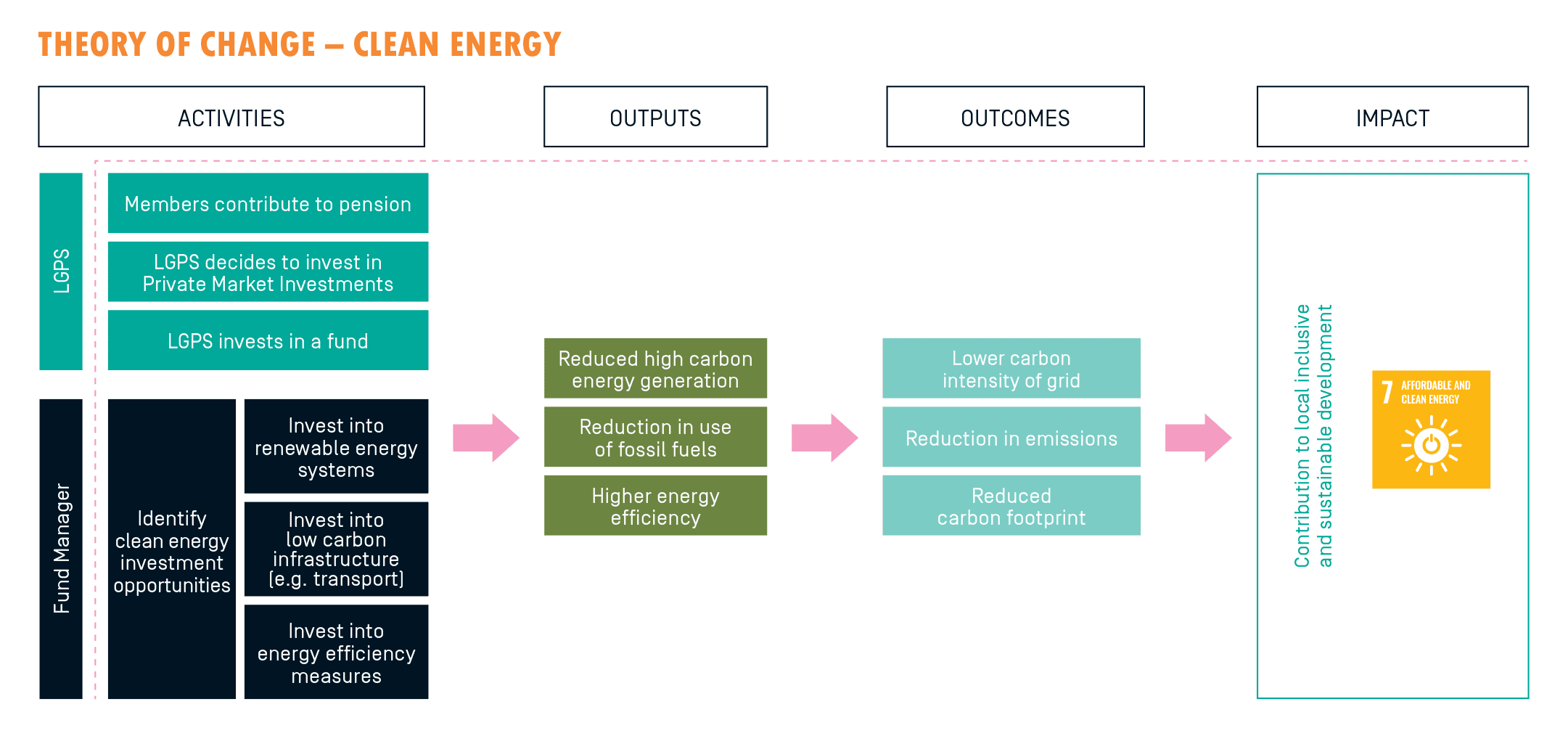

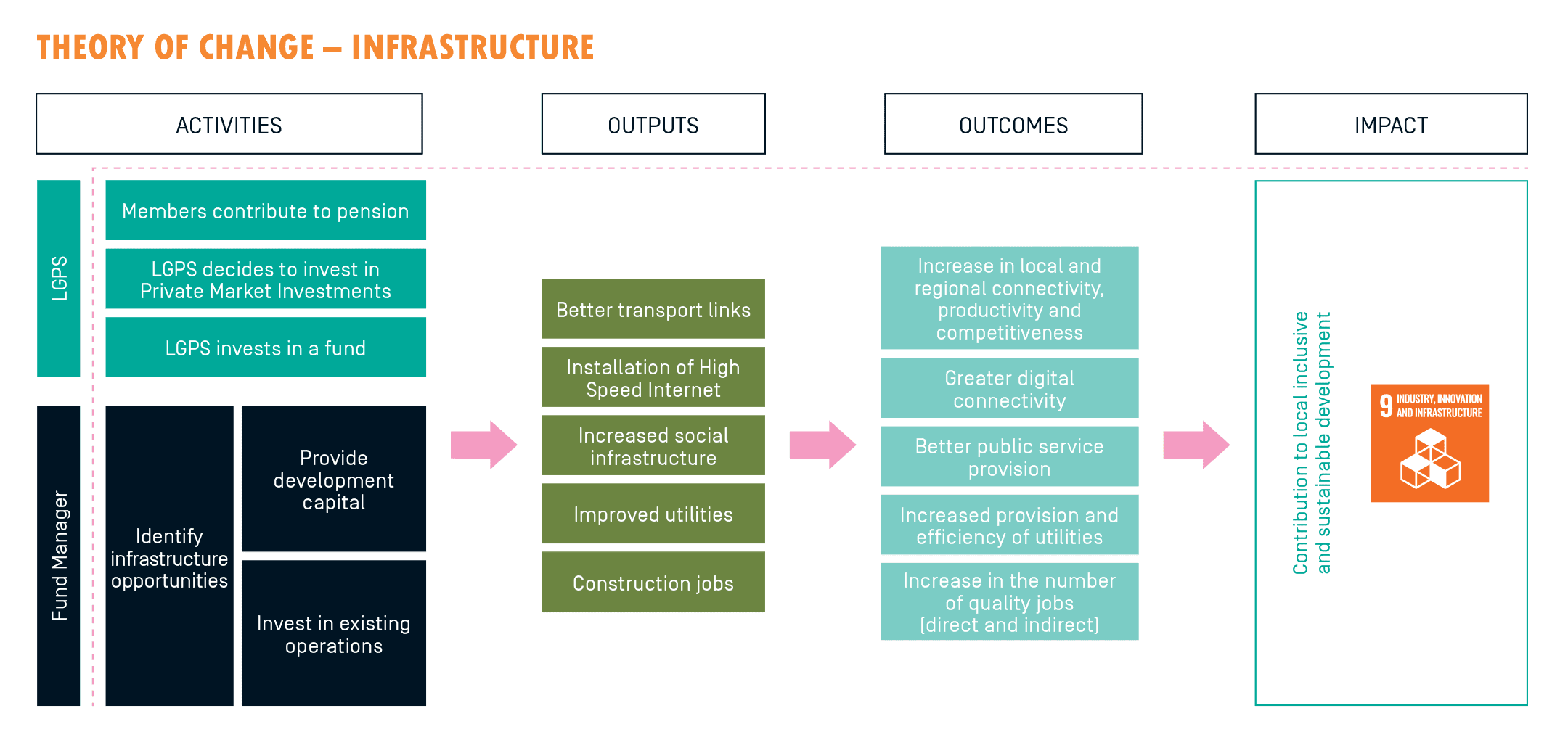

3. Theory of Change

A ‘theory of change’ is a conceptual model used to describe and map out how specific inputs and activities lead to positive change, measured in terms of ‘outputs’ and ‘outcomes’. For each pillar we have developed a theory of change. These theories of change are illustrated below and provide a clear starting point for identifying what to measure and manage to maximise impact.

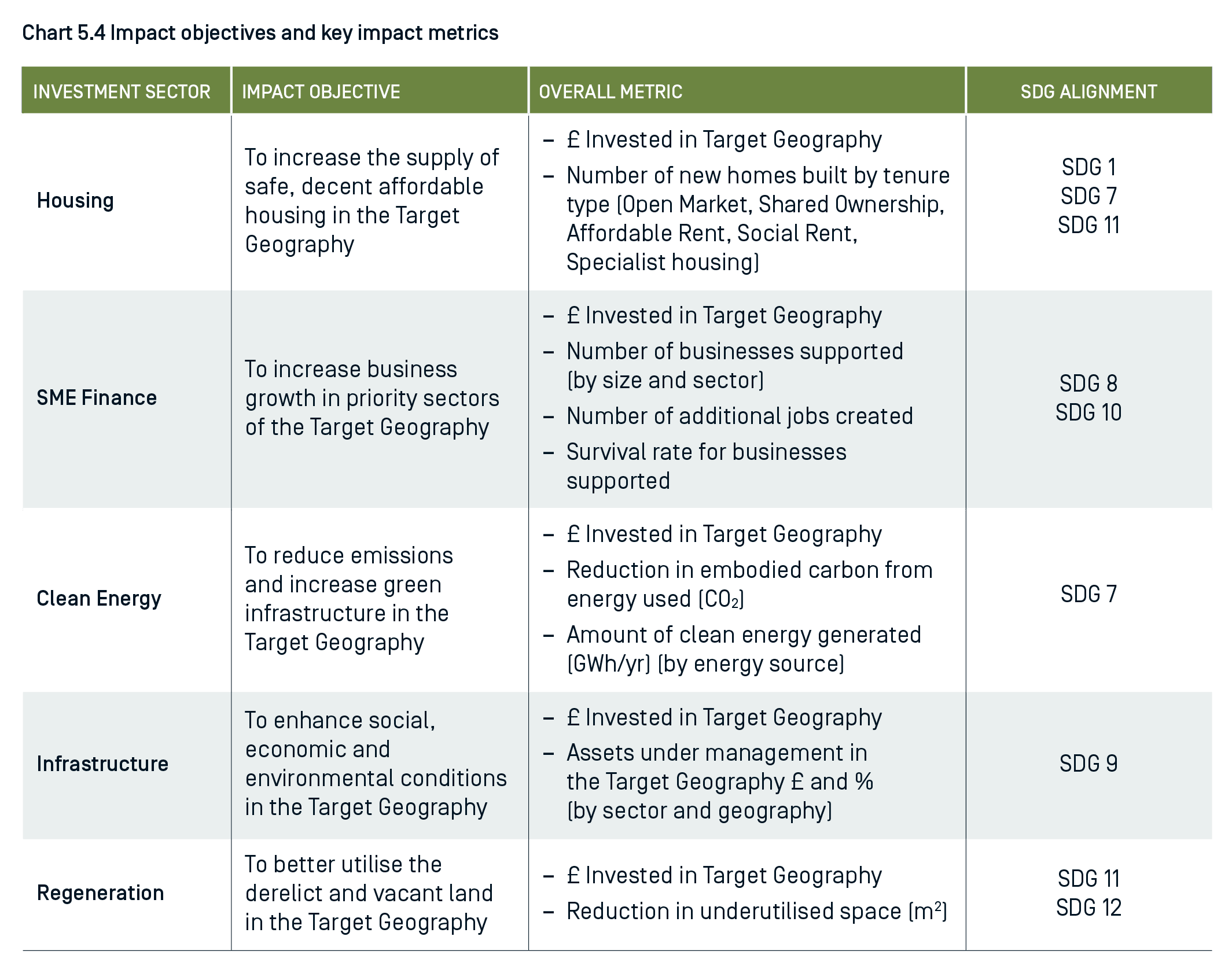

4. Impact Metrics

The Good Economy developed a set of core portfolio metrics for each impact objective that was reviewed and refined with input from pension fund co-creators (see Chart 5.4 – below). These are aligned to existing frameworks and metrics where possible. These core metrics are proposed as a minimum impact reporting standard.

We recognise these measures are output rather than outcome measures. However, they do provide a useful, high-level snapshot of the nature and scale of the LGPS fund’s investments in a particular locality.

Where the LGPS fund would like to report more fully on its place-based impact it would need to work with its fund managers to collect outcome data and more detailed analysis of local benefits.

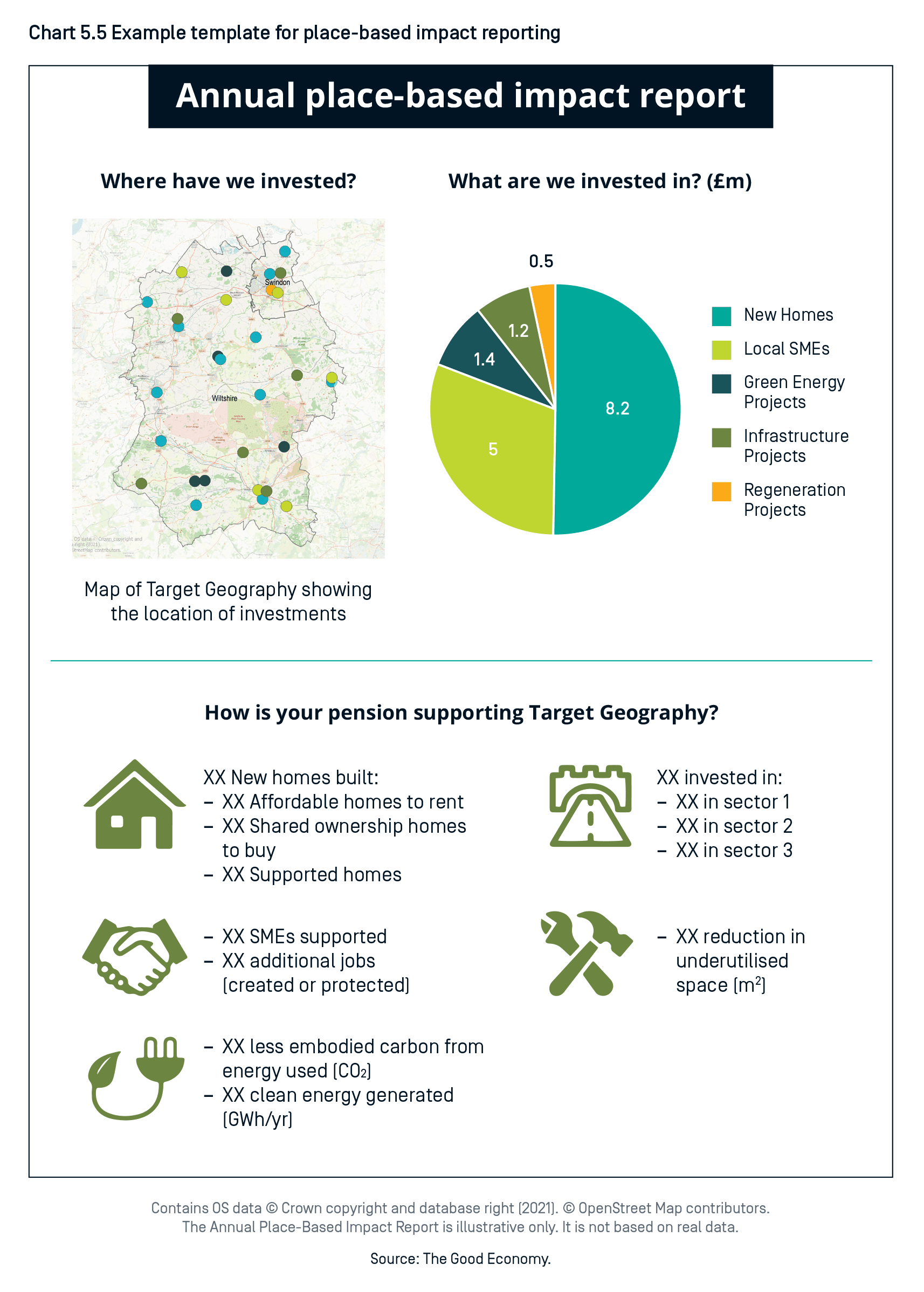

5. Impact Reporting

By defining simple standardised metrics, LGPS funds will now be able to approach fund managers with a clear expectation on reporting requirements. We recommend that reporting against these core portfolio metrics is done as part of existing reporting on fund performance. The LGPS funds would be able to collate individual fund data submissions to create an overall portfolio impact report. We have created an example template one-page report that the LGPS funds could populate and share with members in their annual report (see below). This is basic, minimum reporting.

Good PBII impact reporting would combine quantitative and qualitative data, including stakeholder voice, to provide a holistic view of impact creation.

6. Impact management

PBII requires an ongoing process of impact measurement, management and reporting as described at the start of this section. LGPS funds, and other institutional investors, should seek to identify fund managers with a genuine commitment to positive impact creation and an ability to actively manage and report on impact creation as well as financial performance in a robust and authentic manner. This requires both LGPS funds and fund managers developing policies and processes to ensure impact creation and performance monitoring is considered throughout the investment cycle.

The Impact Management Project (IMP) – ABC categorisation of impact

LGPS funds could also consider using the IMP Impact Class system to measure and report on their impact. The Impact Class system is a useful approach to classifying investments at the portfolio level based on the impact of the underlying asset(s) and the contribution the investor makes to that impact. Impact classes help differentiate the type of impact that investments have, even when very different measurement approaches are used.

- Avoiding harm;

- Benefiting stakeholders; or

- Contributing to solutions.

The ‘ABC’ component of the impact classes is determined through analysis of impact data – quantitative, qualitative, and ESG data – of the underlying assets using the IMP five dimensions of impact (what, who, how much, contribution, risk).

The approach can be used across all asset classes. The classification of the underlying asset is combined with a classification of the contribution the investor makes to that impact, depending on how active or passive an investor is and the extent to which capital is being provided to markets that lack access to capital. By categorising each investment against one of these types, an LGPS fund could report against their overall distribution of A, B and C investments and potentially set targets aligned to these for their fund managers.

Example sector – housing

The below summary lays out a potential way of identifying the degree of impact of investments in housing:

- A – avoid harm: The Fund has a negative ESG screen, but most of the investment is housing for market sale or private rental sector.

- B – benefit stakeholders: The Fund is building a mix of regulated affordable homes, but the majority is for market sale or private rental sector.

- C – contribute to solutions: The Fund is building a majority of regulated social and affordable homes which will benefit households on low incomes, for example those waiting for homes on the local authority’s housing list.