The investor focus of our joint white paper ‘Scaling up institutional investment for place-based impact‘ on which this module is based, is the Local Government Pension Scheme (LGPS). The £326bn LGPS is the largest public sector pension scheme in the UK with more than five million members ranging from local government employees to teachers, police staff and people working in the voluntary sector. These pension funds are locally managed by 98 sub-regional Administering Authorities.

The LGPS has a place-based administrative and membership geography. Environmental, social and governance (ESG) integration and alignment with the Sustainable Development Goals (SDGs) are becoming increasingly important to investment strategies, and there is a legacy and current interest in local investing. If 5% of LGPS funds were allocated to local investment this would unlock £16 billion for PBII, more than matching public investment in levelling up.

The current level of place-based impact investing for the Local Government Pension Scheme

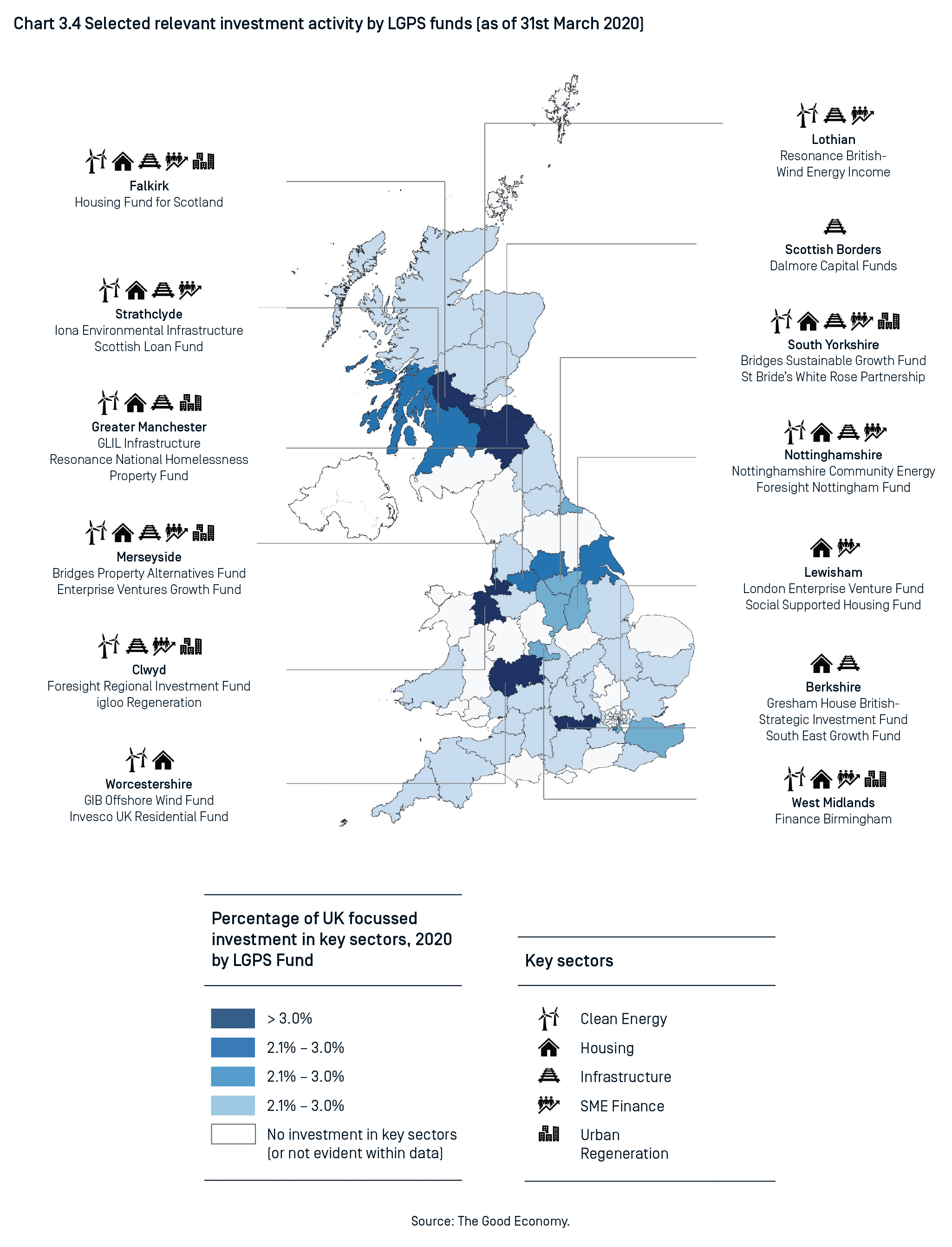

The 2021 white paper. “Scaling up institutional investment for place-based impact”, reviewed the LGPS holdings data to identify which investments are in key sectors (as defined by the pillars in our conceptual model) and have exposure to the UK. The nature of the data available makes it impossible to analyse whether the investments have the key traits of PBII per se. However, it is within this group of investments we will find investments supporting place-based development and delivery of positive local impact.

The level of UK investment by the LGPS in key sectors in the UK is currently very small.

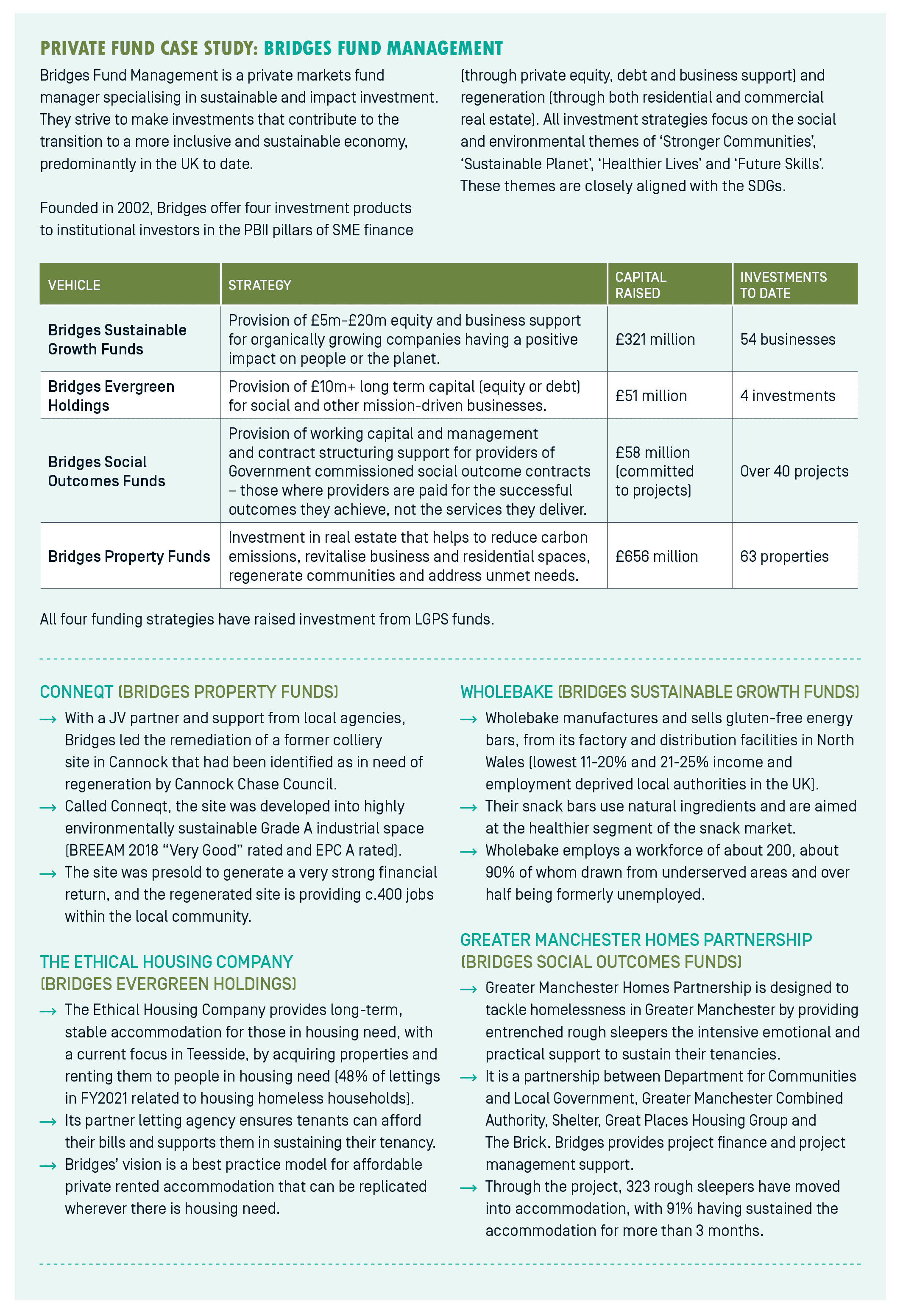

As of March 2020, the value of investment in the five sectors outlined as PBII pillars totalled £7.7 billion – only 2.4% of the total value of the UK LGPS. At least £3.2 billion (1% of the UK LGPS) of this £7.7 billion is invested in the key sectors with some degree of exposure to the UK (for instance funds with a European or Global footprint with assets in the UK). Regional or local investments in PBII sectors by LGPS funds amounted to just £300 million.

Strathclyde, Greater Manchester and West Yorkshire largest commitment to place-based impact investing

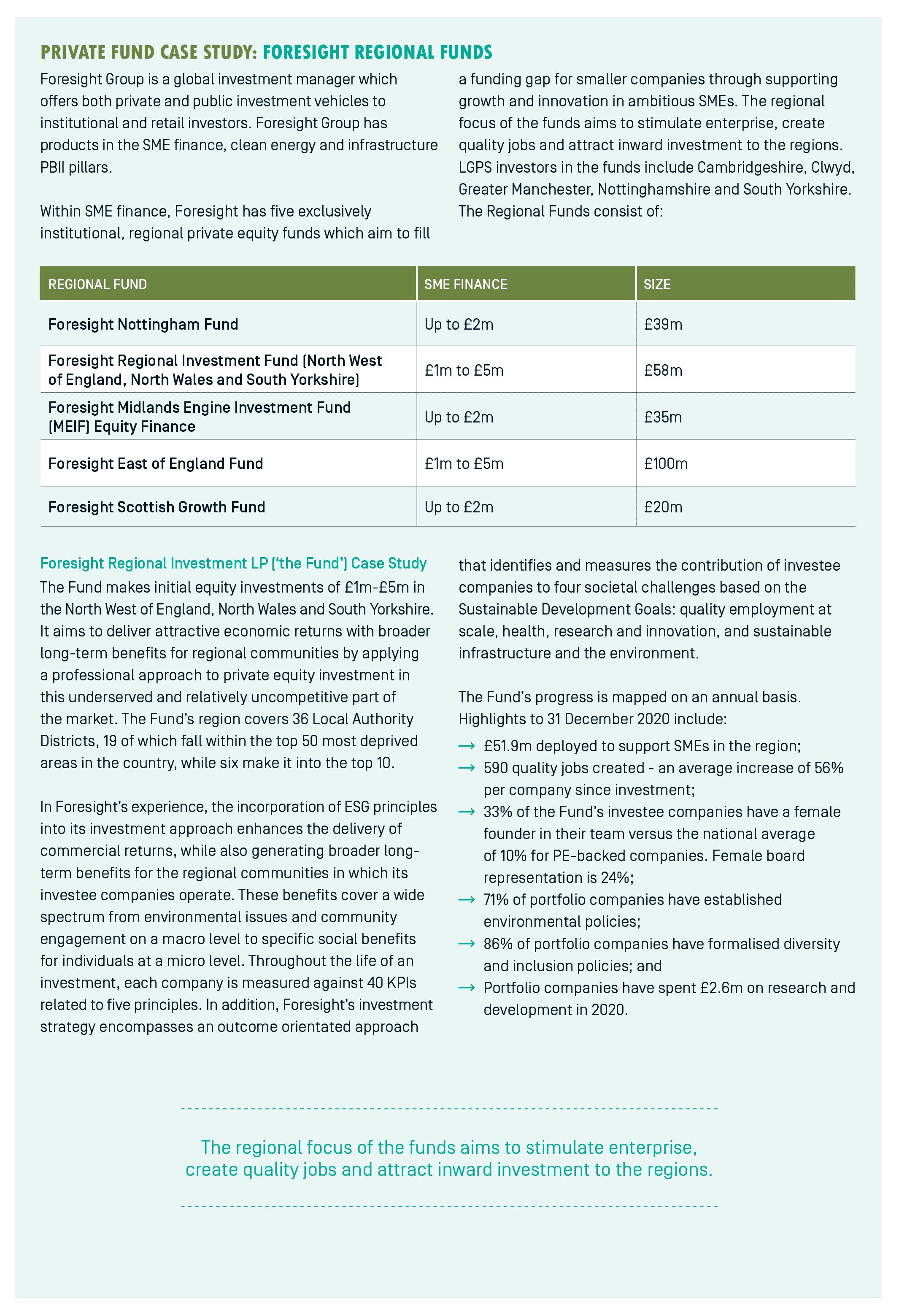

Just over half the LGPS funds have made investments in the five key sectors within the UK. However, only seven funds made allocations of more than 3%. The majority of LGPS funds making such investments (36) made allocations of less than 1% (see chart 3.3). The top three largest investors in terms of amounts invested in key sectors in the UK are Greater Manchester (£477 million), Strathclyde (£462 million), and West Yorkshire (£335 million).

Pension fund best practice

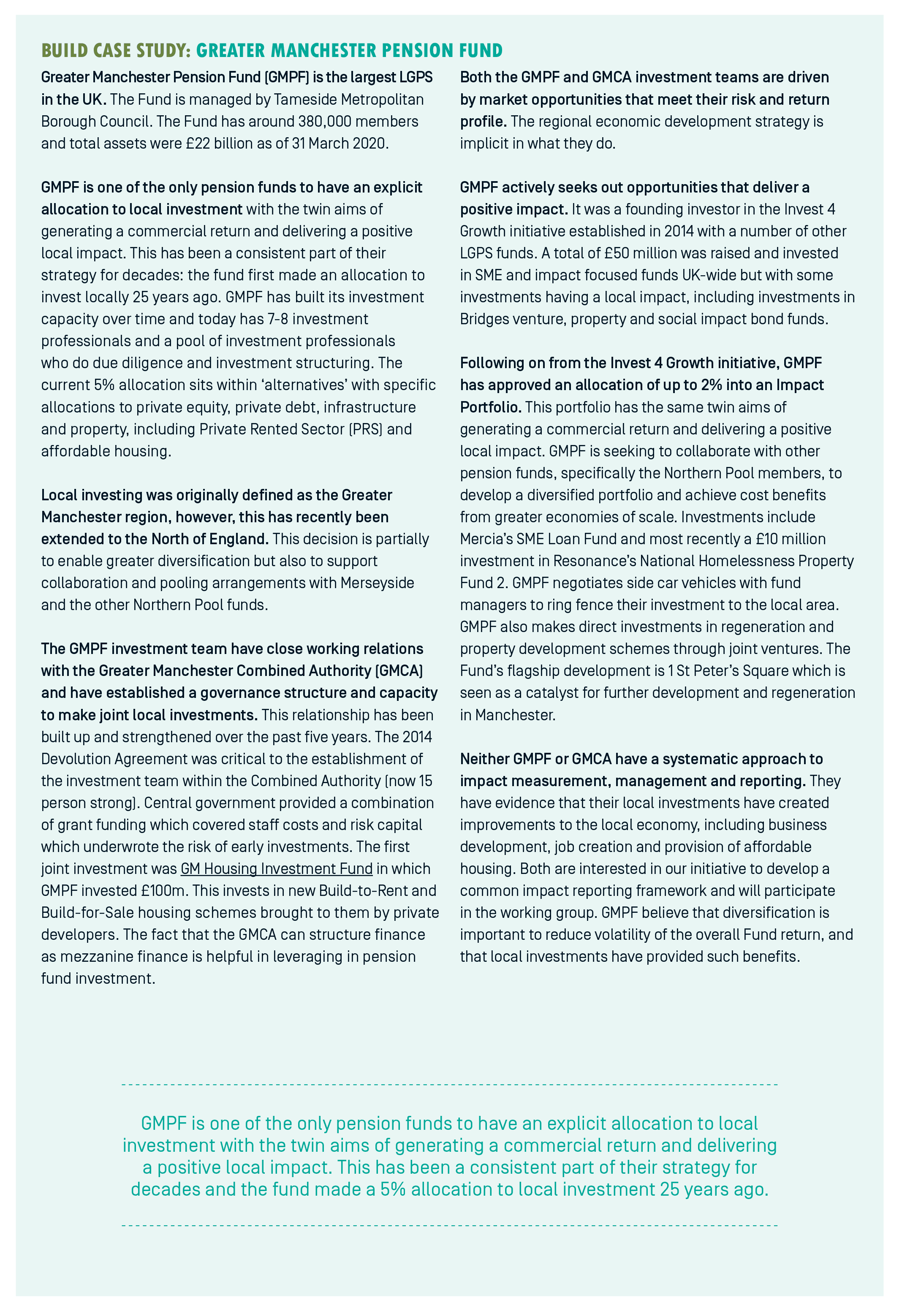

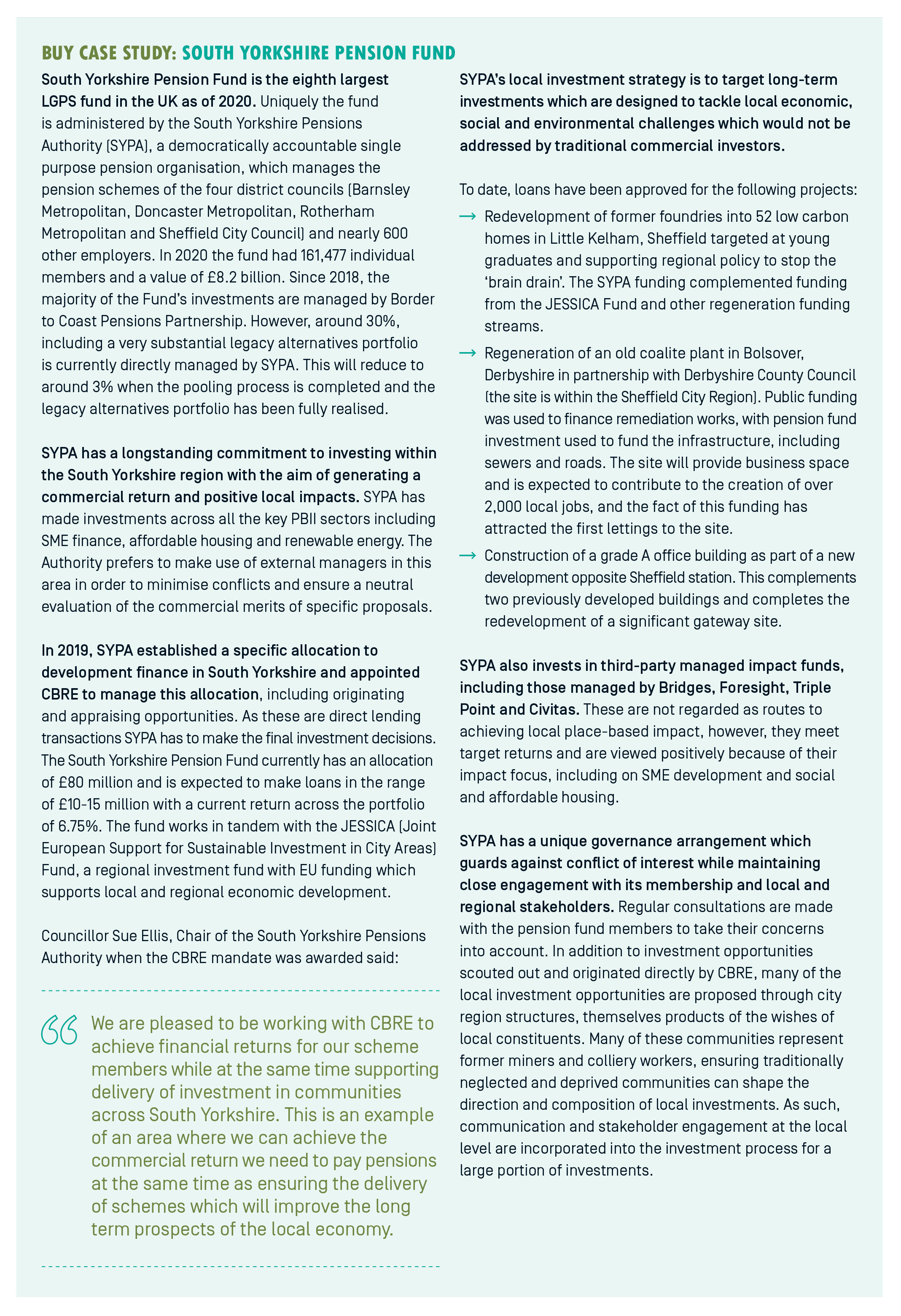

The case studies below outline the approach and strategy pension funds can apply to place-based impact investing. Our research has found that good commercial investment opportunities that achieve positive place-based impacts exist within all our key sectors.

It appears that the universal requirement to scaling up PBII is an increase in operational resource across the ecosystem. This is needed to create commercial investments, analyse these investments and aggregate them into viable institutional funds. Resources are needed by local authorities, LGPS investment teams, consultants and fund managers. The investment returns from proper resourcing appear to reward the cost, as exemplified by the experience of Greater Manchester and South Yorkshire pension funds (detailed below).

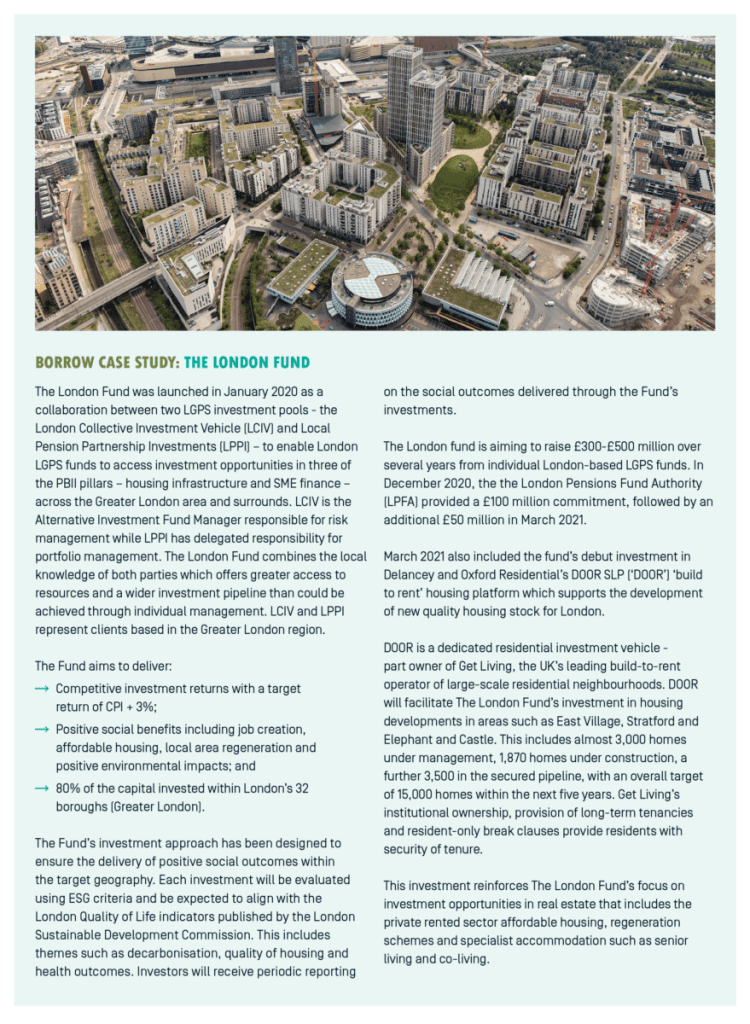

A cost cutting approach from origination to fund management will work against the objectives of growing PBII and the benefits to the local economies. In order to meet this capacity challenge, we have observed approaches we broadly classify as ‘building’ capabilities, ‘buying’ in the skills or ‘borrowing’ the capacity from other institutions e.g. government-backed development finance institutions or pension pools. Greater Manchester Pension Fund provides a leading example of an LGPS fund which has built significant capacity for place-based investing and also buys in expertise. South Yorkshire Pension Authority has relied on buying in expertise, primarily from CBRE to help source investments and manage funds. In London, LGPS funds can borrow capability from the pension pools which have created the London Fund to make place.

LGPS impact investment strategies

There are three main ways in which individual LGPS funds have made PBII-aligned investments:

- Direct Investments – here the LGPS fund invests directly in a project or business, and there is no fund manager between the LGPS investment committee and the underlying investment. Such investments are relatively rare, although they can offer a good route to local impact creation (see Nottinghamshire Community Energy case study).

- Co-investment strategies – here the pension fund coinvests with a trusted partner in a specific place-based project or investment vehicle with a targeted purpose with both parties committing capital. An example of a trusted partner could be a local development firm or a private equity firm with specialist sector knowledge. Co-investment strategies are a good vehicle for PBII as they typically involve a high degree of local stakeholder engagement and the partner brings expertise to develop and deliver projects. There is an opportunity to scale up such co-investment models, including models bringing institutional investors together with local partners in the private sector, public sector and social sector, including local housing associations and universities.

- Third-party managed funds – here the investments are wholly managed by an intermediary fund manager who sits between the LGPS fund and the investment. This may be either where the LGPS funds are pooled with other investors (“Pooled Fund”) or held separately for the LGPS (“Segregated Fund”). The overwhelming majority of LGPS funds are third-party managed. Funds are either private funds or listed on a stock exchange.

Direct investments case study

Co-investment strategies

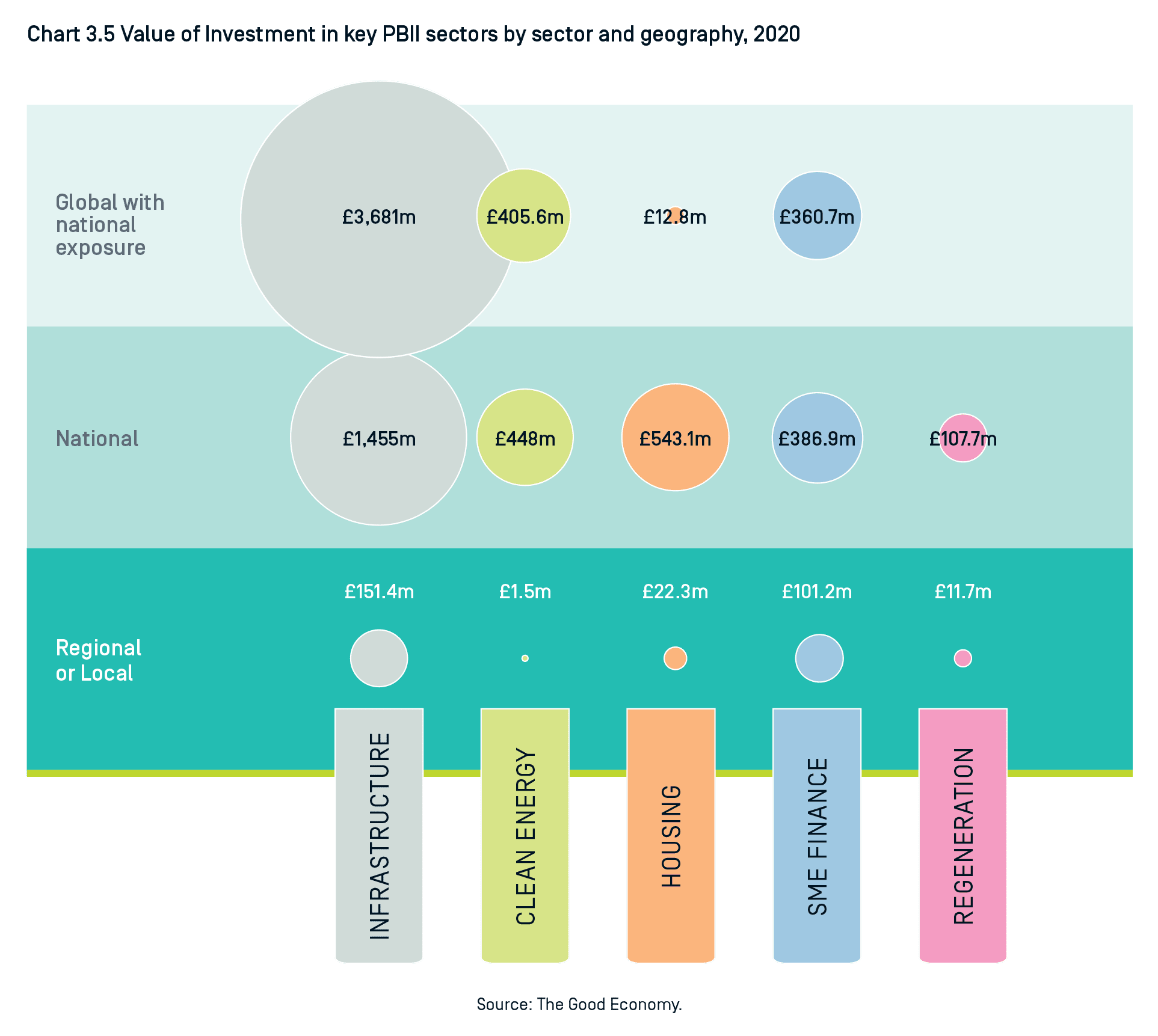

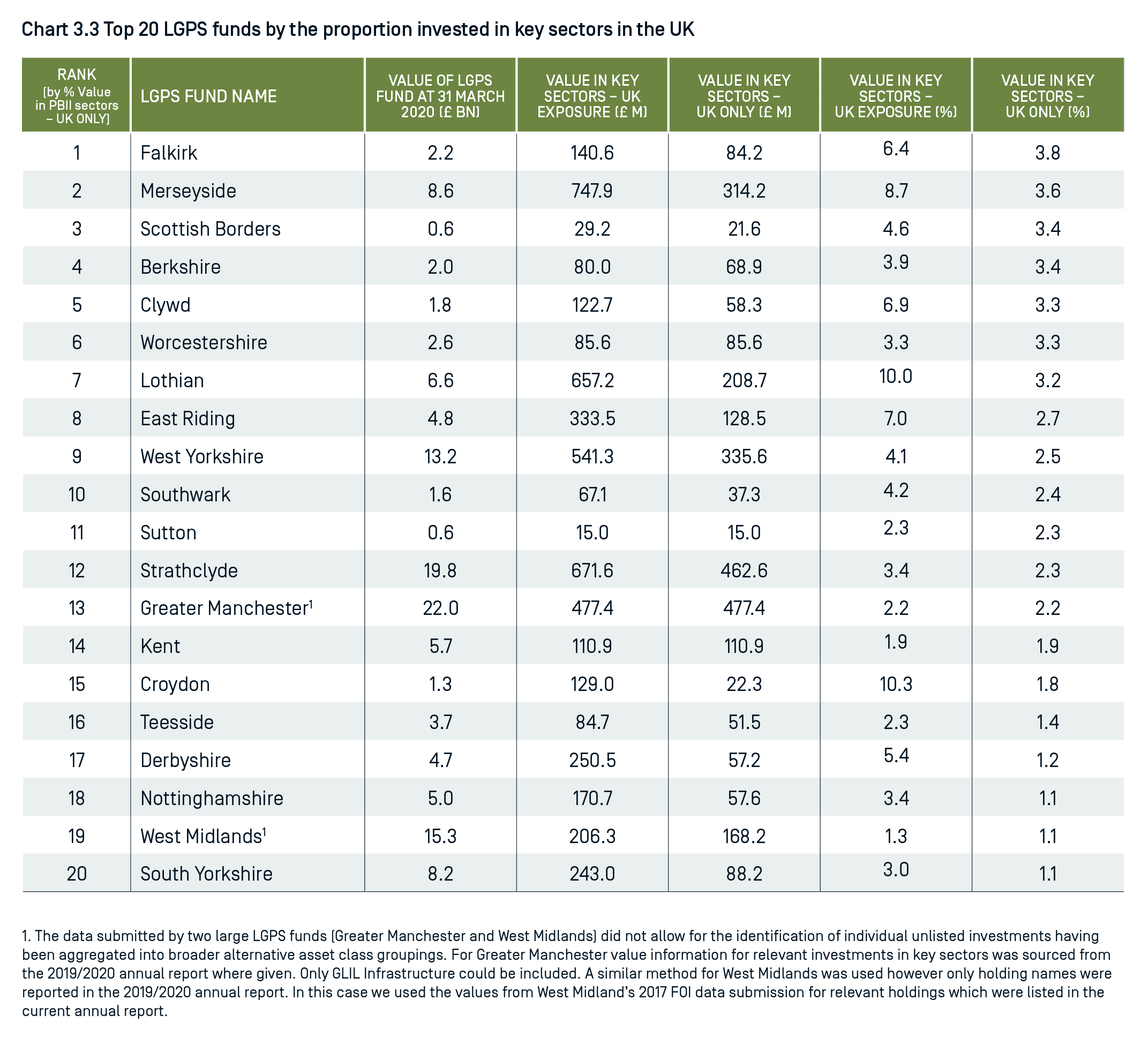

Third-party managed funds