“Investments made with the intention to yield appropriate risk-adjusted financial returns as well as positive local impact, with a focus on addressing the needs of specific places to enhance local economic resilience, prosperity and sustainable development.“

Definition of place-based impact investing. Source: The Good Economy.

Inequalities between regions and places are more extreme in the UK than in most comparable economies and have existed for generations. The coronavirus pandemic, coupled with the political realities of Brexit, has moved this reality to the centre stage of public debate.

The need for more public investment to address those inequalities is undeniable and the political will appears to be in place. More importantly, the research captured in our joint white paper “Scaling up institutional investment for place-based impact” published together with The Good Economy and Pensions for Purpose shows that place-based impact investing provides good opportunities for private capital to deliver financial return, match public investment, and deliver positive environmental and social impact in places and communities across the UK.

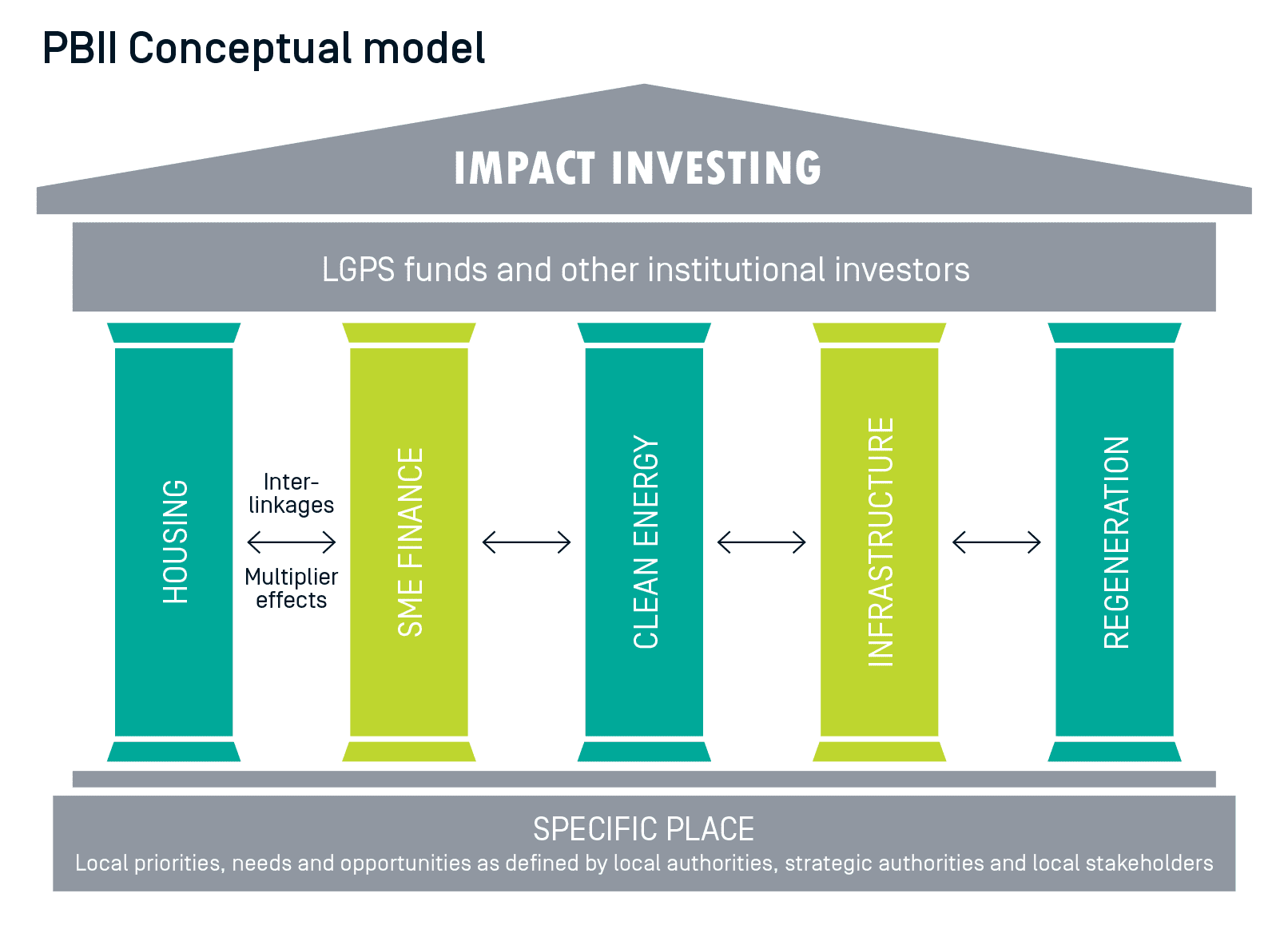

A conceptual model for place-based impact investing

The conceptual model or “architecture” below provides an overall picture of how to think about place-based impact investing.

There are two central players in the framing of a place-based impact investment:

- As place-makers, local authorities and their strategic partners are the model’s foundation stone. Place-based impact investing always starts with the needs, and desires of the place itself.

- Potential investors in a place sit at the top of the architecture.

These two disparate groups – local authorities and investors – are joined by five pillars that serve as dual structures. On the one hand, they represent policy themes or priority areas likely to feature in most local and regional development strategies. On the other hand, the pillars are also sectors that fall within institutional investment strategies. These pillars are, of course, not an exhaustive list, and others can be added where appropriate in step with local priorities – for example, agriculture and forestry which are important to rural authorities and investors.

The pillars must bear the weight of investor risk-return expectations while meeting the inclusive-sustainable development expectations of local authorities. Successful delivery of PBII should and can be a win-win game.

The five pillars of PBII

1. Affordable housing

Affordable Housing is a cornerstone of community and economic development, generating health, employment and community wellbeing benefits. Many UK cities are facing housing affordability crises, and therefore investing in genuinely affordable housing is a top priority for PBII.

Housing associations are important providers of affordable housing and recognised as ‘anchor institutions’ and partners for institutional investors in place-based development. Affordable housing investment products may include social rent, affordable rent, shared ownership, private sale, private rent, specialist supported housing, and shared living (e.g. independent living for older people).

Such investments are typically managed by real estate investment firms as well as specialist social housing fund managers. Institutional investors also invest in bonds issued by housing associations.

2. Small and Medium Enterprise (SME) Finance

SMEs form the backbone of local economies and account for more than 60% of private sector jobs. They play a central role in localised growth given their spread across high and low wage/skill sectors and their presence across all communities, towns and regions. SMEs, including start-ups, are a traditional focus of local government policy and industrial strategies.

Investing in local SME development is key to inclusive prosperity and levelling up, particularly investing in growth sectors which provide quality jobs and support the transition to a green economy. Social businesses, including social and community enterprises, play an important role in more inclusive community-based development and community wealth-building. Both minority and female owned SME’s are a particularly powerful locus of investment for driving impacts, encouraging wealth-building in long-term underrepresented and marginalised groups.

SME finance includes venture capital, debt and private equity. Investment organisations include SME fund managers, often investing in specific high-growth sectors, Community Development Finance Institutions (CDFIs), as well as specialist social investment intermediaries funding social enterprises.

3. Clean energy and energy efficiency

Clean energy is prioritised in the Government’s Industrial Strategy – new green industries, businesses, technologies and jobs – as well as in ‘build back better’ policies aimed at renewing and decarbonising towns and cities. Clean energy has been a focus of place-based initiatives for decades. It is now a major focus for institutional investors, including pension funds, who are tied into commitments to reduce the carbon footprints of portfolios and meet net zero targets.

Investments include solar, wind and other renewable energy sources, waste-to-energy, green technologies, retrofitting and installation of electric car charging points. Such investments are typically managed by specialist investment firms.

4. Infrastructure

Investing in infrastructure can have a powerful multiplier effect and play a critical role in supporting local communities and the local economy. They can unlock an area’s potential, enable residents to access new education, skills, and work opportunities, support local retail and business areas, and increase the viability of new sites for homes and businesses.

Scaling up infrastructure investment is a central plank of the Government’s levelling up agenda and a priority for many local and combined authorities. Infrastructure investments include transport (such as roads and bridges), utilities, telecommunications and social infrastructure (such as schools and hospitals). These are large-scale, long-term investments in physical (real) assets managed by specialist investment firms.

5. Regeneration

Regeneration in this context refers to physical development – from the remediation of contaminated ‘brownfield’ land and public realm improvements to town centre regeneration projects and office and retail development – but not the social capital aspects of regeneration, such as community development and employment and training. Authorities tend to pursue a holistic, joined up approach to physical and social regeneration. Local authorities are already busy reviving existing assets such as government buildings and empty offices and high street shops.

Institutional capital can therefore have place-based impacts by investing in regeneration schemes and helping to ‘re-purpose’ town centres. Investors include those who fund new developments and those who acquire properties once built.

Place-based impact investing defines a place

The five traits of place-based impact investing

The focus of the joint white paper ‘Scaling up institutional investment for place-based impact‘ on which this module is based, is on how to scale up institutional investment in ways that deliver tangible benefits for local people and places in order to achieve more inclusive and sustainable development across the UK. But what defines and distinguishes place-based impact investing?

Building on our definition and conceptual model it is possible to identify five traits that characterise place-based impact investing:

- PBII has a clear intentionality to achieve a positive impact.

Intentionality is a key characteristic of impact investing. Typically, intentionality is defined in relation to addressing a defined social or environmental need. PBII investors need a bifocal lens – focusing on both ‘place’ and ‘impact’ is necessary. Intentionality in PBII should be geographically bounded – where you are seeking to create a positive impact is defined, alongside the types of social and/or environmental outcomes to be achieved. Such intentionality can be articulated by having impact objectives as well as financial objectives within an investment strategy.

- PBII defines place.

PBII is about directing more capital to the UK and its local areas and regions using a place-based lens. This is in contrast to the status quo, as the vast majority of LGPS capital is currently invested in global funds and large multinational companies in the listed markets and only a small fraction is invested directly in the UK’s real economy.

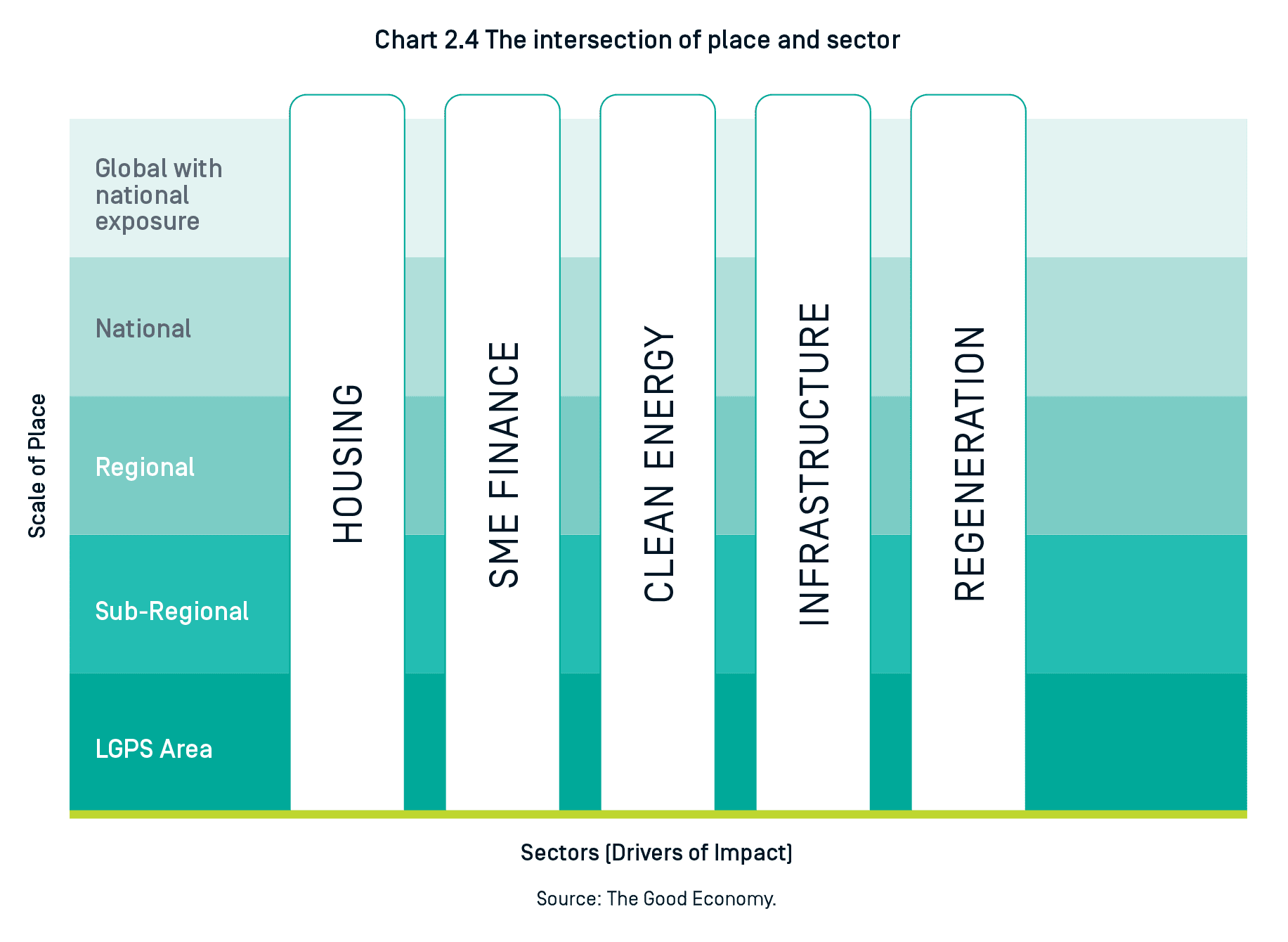

Effective PBII needs to consider the cross-cutting nature of ‘place’ and ‘sectors’ (see Chart 2.4, above). The target geography may differ by sector. For example, for LGPS funds infrastructure investments may focus at the UK level, whereas small- and medium enterprise (SME) investments may be targeted to a local area or region. A PBII approach is focused on the subnational level – investing in ways that benefit specific local areas or regions.

- PBII engages with local stakeholders.

Effective stakeholder engagement is a core trait of PBII. We regard PBII as aligning with and supporting locally-defined development objectives and priorities. It is the role of local and combined authorities to determine strategic development plans and these bodies should be regarded as key stakeholders at a strategic and project planning level. For individual projects or investments, stakeholder engagement should be widened to include all relevant local stakeholders in the project planning and design and how an investment can maximise local benefits, and mitigate any negative risks. Particular care should be taken to solicit the views and ideas of underrepresented groups and racial minorities.

- PBII involves robust impact measurement, management and reporting.

For PBII, impact creation needs to be properly mapped and measured. Hence, we need to know the geographical locus of these impacts – ‘where’ is the next frontier of impact investing, from where the capital originates to where it is deployed for the benefit of people in places. Our approach to PBII impact measurement, management and reporting is presented in the reporting section of this module.

- Finally, collaboration is critical to PBII.

There is often a fragmentation and lack of alignment in decision-making across different stakeholders. Silos and poor alignment also exist within organisations, including government. For example, while one local government department may be focused on social issues and how to invest more in underserved areas, another department will be looking at land and property development from a commercial, revenue-generating perspective. The same applies to investment firms. For example, firms may have teams investing in real estate, another in infrastructure, and another in private equity, all potentially investing in the same places. To optimise their impact in a specific place, coordination across teams is necessary. Such conflicts and lack of alignment can be solved by acknowledging shared impact goals and taking a more place-based approach to investing: creating a “common room” of different players that are core to delivering investment that helps grow and sustain a place.